Sentiment: Bullish

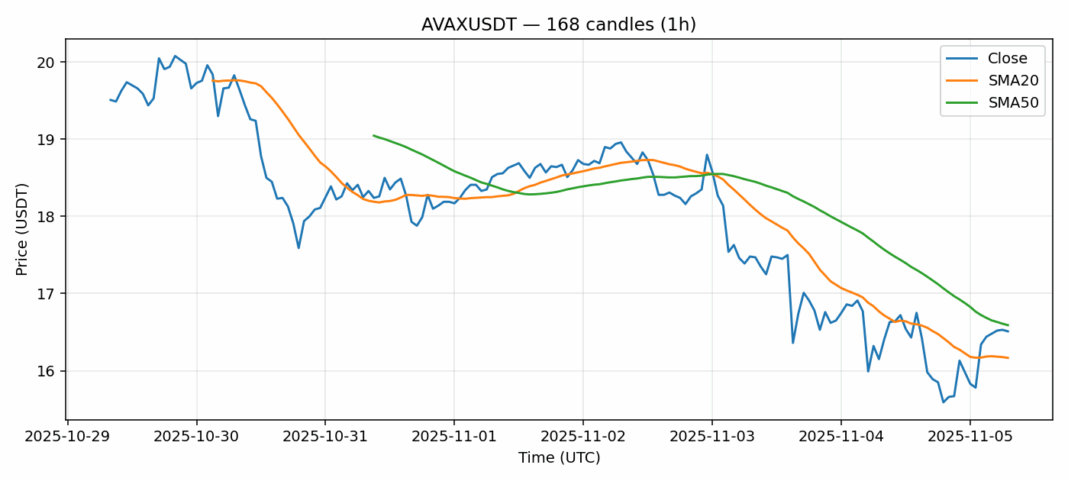

AVAX is showing resilience with a 1.29% gain over 24 hours, trading at $16.51 against USDT. The current price sits above the 20-day SMA ($16.17), indicating near-term bullish momentum, though it remains slightly below the 50-day SMA ($16.59), suggesting some resistance ahead. An RSI of 65.8 points to strengthening momentum but is approaching overbought territory, which could trigger short-term pullbacks. Trading volume exceeding $104 million reflects solid interest, while volatility around 5.85% suggests manageable price swings. Traders should watch for a decisive break above the $16.60 level, which could open a path toward $17.50. Consider taking partial profits near resistance and using dips toward $16.00 as potential entry points, with a stop-loss below $15.80 to manage risk in this cautiously optimistic setup.

Key Metrics

| Price | 16.5100 USDT |

| 24h Change | 1.29% |

| 24h Volume | 104283860.91 |

| RSI(14) | 65.82 |

| SMA20 / SMA50 | 16.17 / 16.59 |

| Daily Volatility | 5.85% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).