Sentiment: Bearish

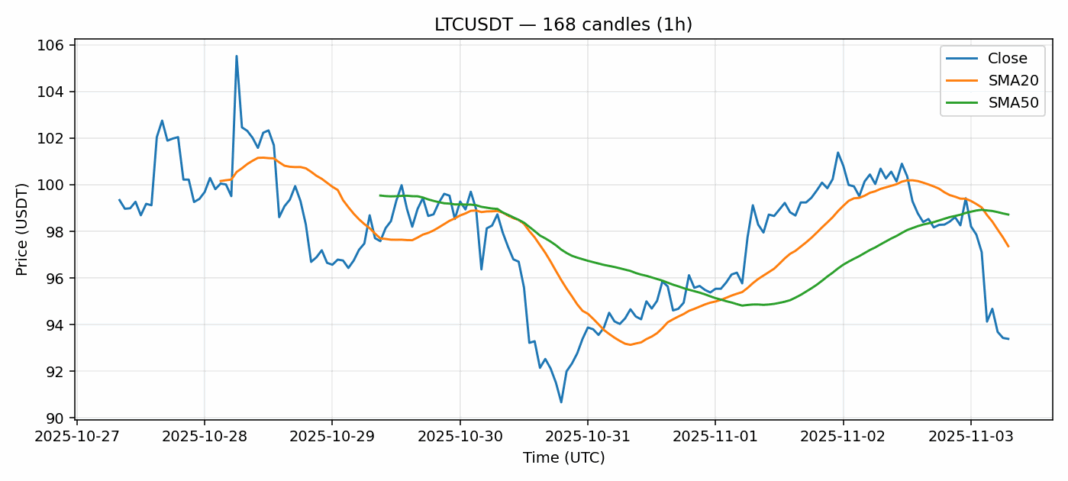

Litecoin is showing concerning technical weakness as it trades at $93.39, down 6.62% over the past 24 hours. The cryptocurrency has broken below both its 20-day SMA ($97.37) and 50-day SMA ($98.72), indicating sustained selling pressure. Most notably, the RSI reading of 23.68 places LTC in deeply oversold territory, suggesting the current downtrend may be overextended. While daily volume of $62.7 million shows decent participation, the high volatility reading of 4.62% indicates significant price swings. For traders, this presents a potential contrarian opportunity – the extreme oversold conditions could trigger a technical bounce toward the $95-96 resistance zone. However, any long positions should employ tight stop-losses below $92, as a break of this level could accelerate selling toward $88. Short-term traders might consider scaling into long positions here with a quick profit-taking strategy, while longer-term investors should wait for confirmation of a bottom formation before committing significant capital.

Key Metrics

| Price | 93.3900 USDT |

| 24h Change | -6.62% |

| 24h Volume | 62710776.78 |

| RSI(14) | 23.68 |

| SMA20 / SMA50 | 97.37 / 98.72 |

| Daily Volatility | 4.62% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).