Sentiment: Bearish

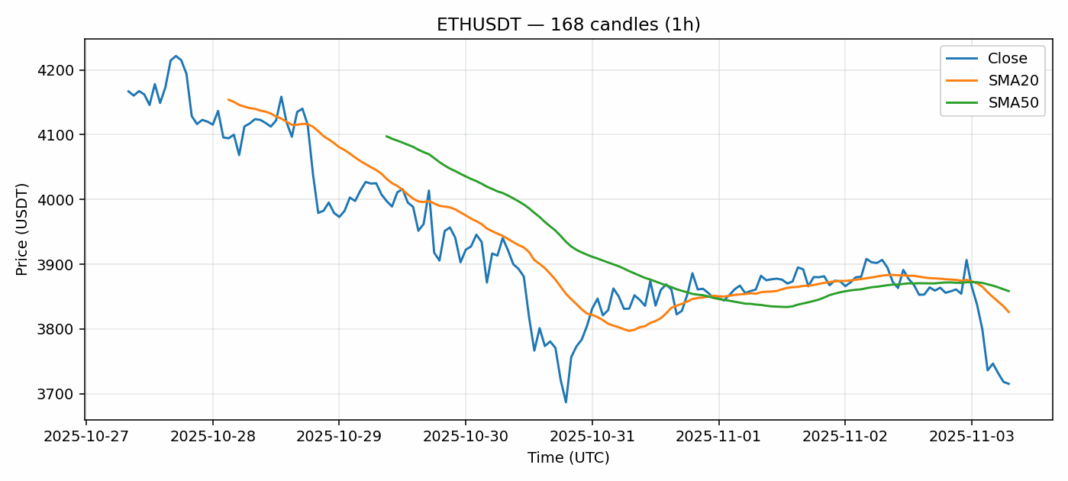

Ethereum continues to face significant selling pressure, with ETH/USDT trading at $3,715.48 after a 4.79% decline over the past 24 hours. The technical picture reveals several concerning signals – the price has broken below both the 20-day SMA ($3,826) and 50-day SMA ($3,859), indicating sustained bearish momentum. However, the RSI reading of 25.1 suggests ETH is deeply oversold, potentially setting up for a short-term bounce. Trading volume remains elevated at $1.62 billion, reflecting active participation in the current move. For traders, this presents a classic dilemma between catching falling knives and waiting for confirmation. Aggressive traders might consider scaling into long positions here with tight stops below $3,650, while conservative investors should wait for a confirmed break above the 20-day SMA before entering. The high volatility of 3.12% suggests position sizing should be reduced accordingly.

Key Metrics

| Price | 3715.4800 USDT |

| 24h Change | -4.79% |

| 24h Volume | 1620050500.17 |

| RSI(14) | 25.10 |

| SMA20 / SMA50 | 3826.35 / 3858.62 |

| Daily Volatility | 3.12% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).