Sentiment: Neutral

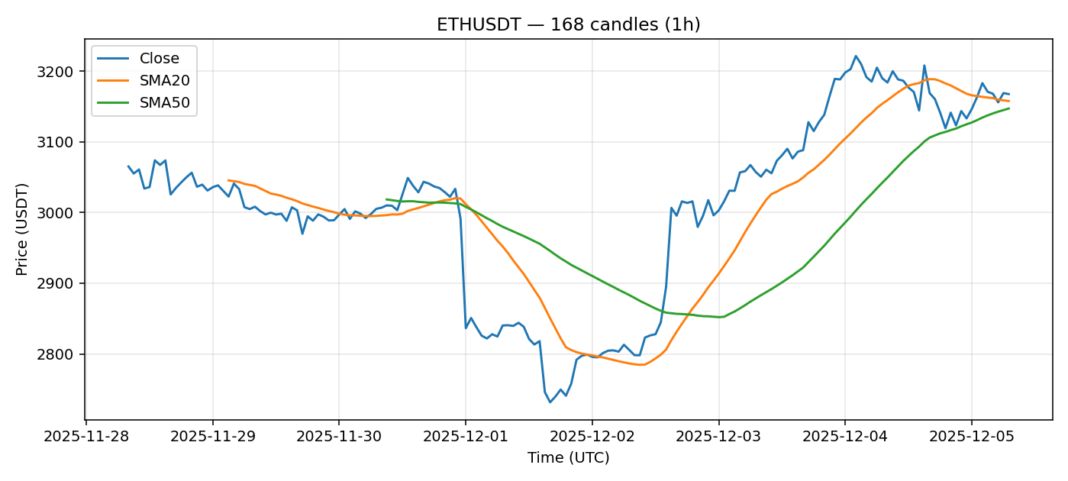

Ethereum is consolidating around the $3,167 level after a modest 1.16% pullback over the last 24 hours. The price action shows ETH trading just above its 20-day SMA ($3,158) and 50-day SMA ($3,147), indicating a neutral-to-bullish near-term structure. The RSI reading of 51.7 sits squarely in neutral territory, suggesting neither overbought nor oversold conditions. Trading volume remains robust at over $1.3 billion, providing solid liquidity for the current range. The key takeaway is that ETH is holding crucial moving average support while digesting recent gains. For traders, the immediate zone between $3,140 and $3,180 appears critical. A sustained break above $3,180 with volume could target the $3,250 resistance area, while a failure to hold the 50-day SMA could see a test of the $3,100 support level. Given the current metrics, a patient approach with defined risk parameters is advisable until a clearer directional bias emerges.

Key Metrics

| Price | 3167.6600 USDT |

| 24h Change | -1.16% |

| 24h Volume | 1314035986.81 |

| RSI(14) | 51.74 |

| SMA20 / SMA50 | 3157.85 / 3147.20 |

| Daily Volatility | 3.67% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).