Sentiment: Neutral

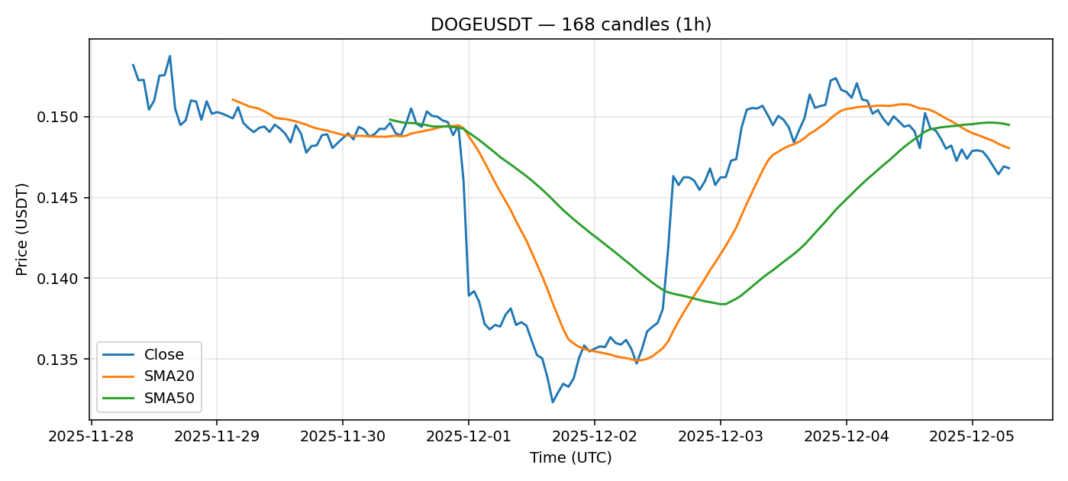

DOGE is showing signs of consolidation after a recent pullback, currently trading at $0.1468 with a 24-hour decline of 2.24%. The technical picture reveals a coin under pressure but potentially nearing oversold territory. The RSI reading of 31 suggests DOGE is approaching oversold conditions, which historically has preceded short-term bounces. However, the price sits below both the 20-day SMA ($0.1480) and 50-day SMA ($0.1495), indicating the near-term trend remains bearish. The 24-hour volume of $88.6 million shows moderate interest, but the 3.56% volatility reading suggests choppy, range-bound action is likely. For traders, the current levels near $0.146 could present a tactical long entry for a mean reversion play towards the $0.149-$0.150 resistance zone, with a tight stop below $0.145. A sustained break below this support would invalidate the setup and likely target lower levels. The broader market sentiment will be key for any sustained directional move.

Key Metrics

| Price | 0.1468 USDT |

| 24h Change | -2.24% |

| 24h Volume | 88607057.79 |

| RSI(14) | 31.07 |

| SMA20 / SMA50 | 0.15 / 0.15 |

| Daily Volatility | 3.56% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).