Sentiment: Bearish

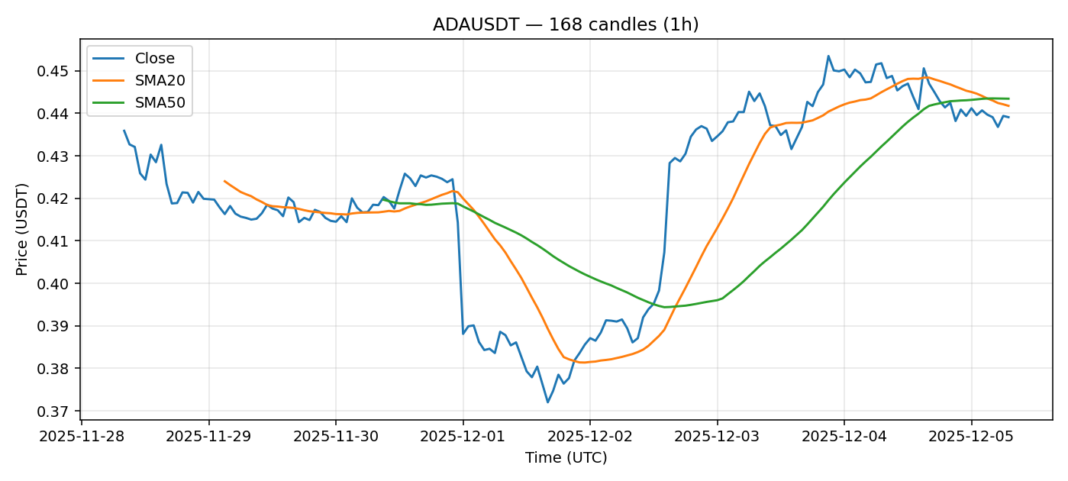

Cardano (ADA) is showing signs of consolidation after a recent pullback, currently trading at $0.4391 with a 24-hour decline of 2.68%. The technical picture presents a mixed but potentially oversold scenario. The RSI reading of 37.96 is approaching oversold territory, suggesting selling pressure may be exhausting. However, ADA is trading below both its 20-day SMA ($0.4418) and 50-day SMA ($0.4435), indicating the short to medium-term trend remains bearish. The 24-hour volume of $38.5 million shows moderate participation, while volatility remains elevated at 4.55%. For traders, this setup suggests caution. The oversold RSI could signal a near-term bounce, but any rally would need to reclaim the $0.443-$0.445 resistance zone (the SMA cluster) to suggest a trend reversal. Until then, the path of least resistance appears lower. Consider waiting for a confirmed break above the 20-day SMA with volume before entering long positions. Downside support to watch is around $0.435, with a break potentially targeting $0.425.

Key Metrics

| Price | 0.4391 USDT |

| 24h Change | -2.68% |

| 24h Volume | 38572153.21 |

| RSI(14) | 37.96 |

| SMA20 / SMA50 | 0.44 / 0.44 |

| Daily Volatility | 4.55% |

Cardano — 1h candles, 7D window (SMA20/SMA50, RSI).