Sentiment: Neutral

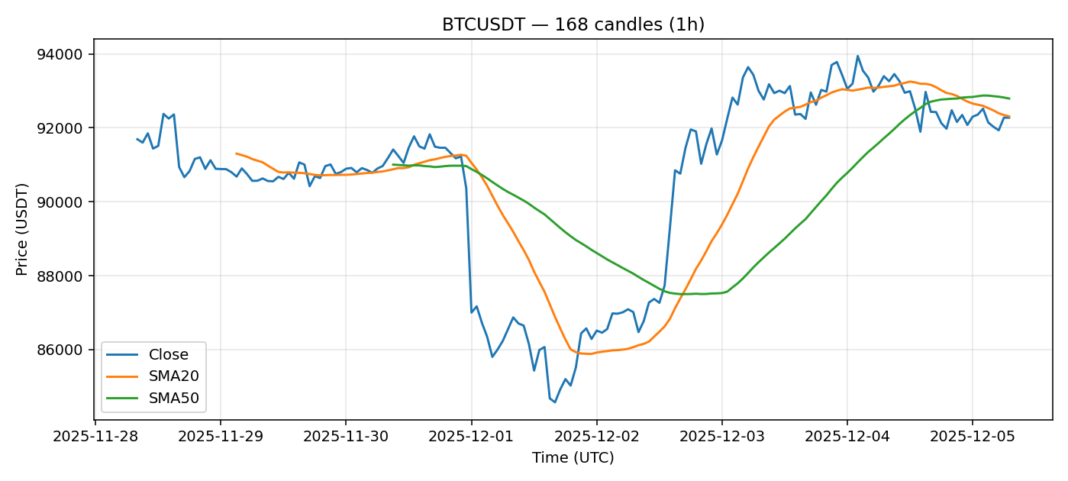

Bitcoin is consolidating just below the $92,300 level after a minor 24-hour pullback of 0.93%. The current price sits marginally below both the 20-day SMA ($92,311) and the 50-day SMA ($92,792), indicating a short-term neutral-to-slightly-bearish technical structure. The RSI at 47.5 is firmly in neutral territory, showing neither overbought nor oversold conditions, which suggests the market is in a state of equilibrium. Trading volume remains robust at over $1.5 billion, providing healthy liquidity. The moderate volatility reading of 2.67% points to a period of relative calm. For traders, this setup suggests a wait-and-see approach. A decisive break and close above the confluence of the 20 and 50-day SMAs could signal a resumption of the uptrend, targeting previous highs. Conversely, a failure to hold support around $91,500 could see a deeper retracement. Risk management is key in this indecisive range.

Key Metrics

| Price | 92275.2600 USDT |

| 24h Change | -0.93% |

| 24h Volume | 1510351904.81 |

| RSI(14) | 47.56 |

| SMA20 / SMA50 | 92311.23 / 92792.43 |

| Daily Volatility | 2.67% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).