Sentiment: Neutral

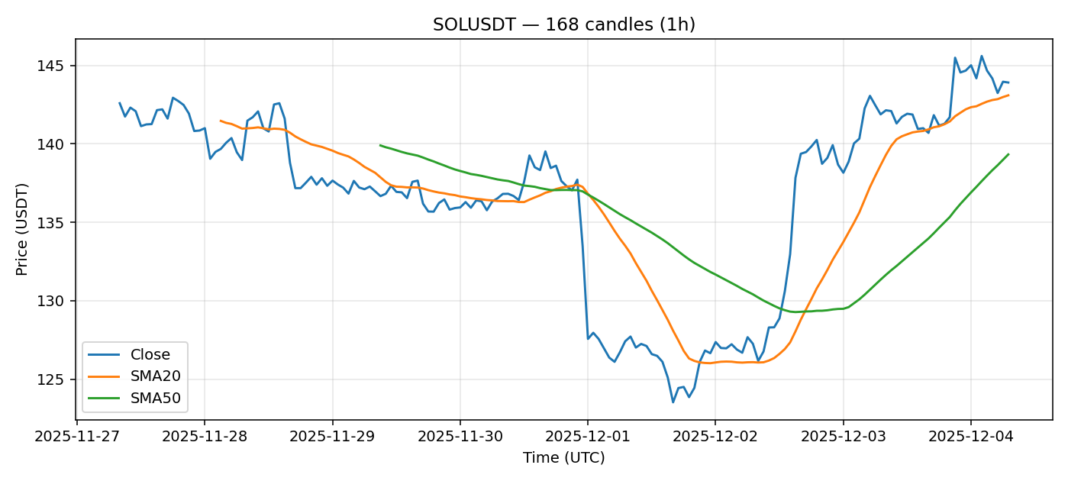

Solana (SOL) is showing constructive price action, trading at $143.91 with a modest 1.08% gain over the last 24 hours. The asset is currently positioned above both its 20-day SMA ($143.09) and 50-day SMA ($139.33), indicating a positive near-to-medium-term trend structure. The RSI reading of 58.84 suggests the asset is in neutral territory, not yet overbought, leaving room for further upside. However, traders should note the elevated 24-hour trading volume of over $481 million, which confirms active participation at these levels. The volatility reading of nearly 4% is significant and warrants caution. For traders, the key level to watch is the 20-day SMA; a sustained hold above it could target a retest of recent highs, while a break below may signal a deeper pullback towards the $139 support zone. Position sizing should account for the inherent volatility.

Key Metrics

| Price | 143.9100 USDT |

| 24h Change | 1.08% |

| 24h Volume | 481214232.07 |

| RSI(14) | 58.84 |

| SMA20 / SMA50 | 143.09 / 139.33 |

| Daily Volatility | 3.90% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).