Sentiment: Neutral

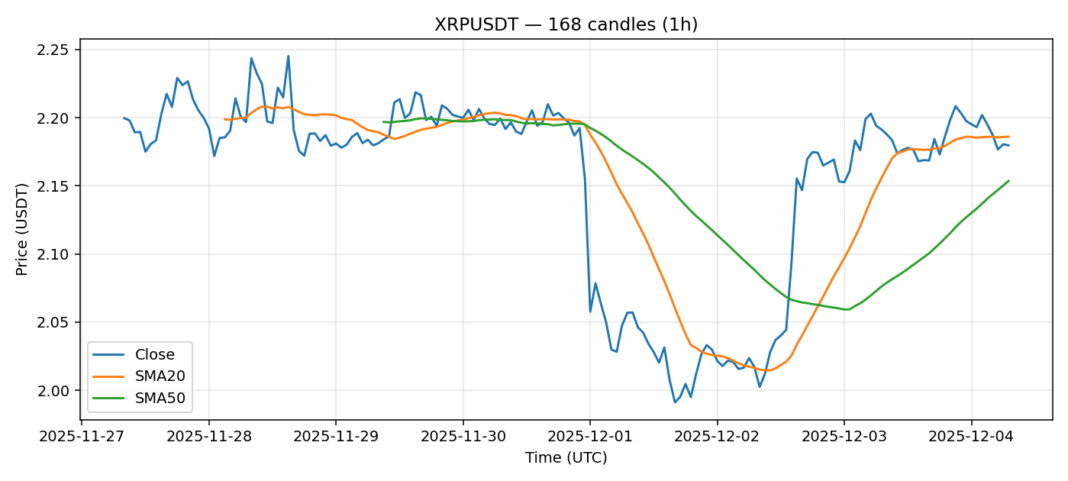

XRP is consolidating around the $2.18 level after a modest 24-hour decline of 0.87%. The price is currently sandwiched between the 20-day SMA at $2.186 and the 50-day SMA at $2.154, indicating a critical inflection point. The RSI reading of 47.67 suggests a neutral momentum bias, neither overbought nor oversold. However, the elevated 24-hour trading volume of over $211 million signals significant institutional or whale interest at these levels, providing underlying support. The 3.55% volatility metric indicates a relatively calm market environment for XRP, which often precedes a decisive move. Traders should watch for a sustained break and close above the 20-day SMA as a potential signal for a retest of recent highs. Conversely, a failure to hold the 50-day SMA could see a deeper pullback toward the $2.10 support zone. Position sizing and strict stop-losses are advised given the current equilibrium.

Key Metrics

| Price | 2.1797 USDT |

| 24h Change | -0.87% |

| 24h Volume | 211305204.26 |

| RSI(14) | 47.67 |

| SMA20 / SMA50 | 2.19 / 2.15 |

| Daily Volatility | 3.55% |

Ripple — 1h candles, 7D window (SMA20/SMA50, RSI).