Sentiment: Neutral

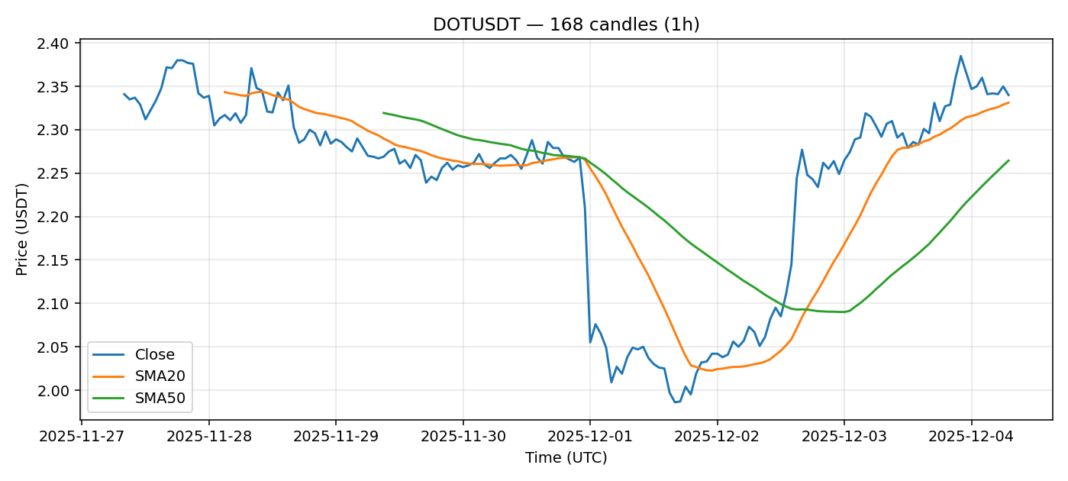

Polkadot (DOT) is showing tentative signs of stabilization after recent volatility, currently trading at $2.34 with a modest 1.7% gain over the past 24 hours. The technical picture presents a mixed but cautiously optimistic outlook. The price is hovering just above its 20-day SMA ($2.331), having recently reclaimed this short-term moving average, while remaining comfortably above the 50-day SMA ($2.264). This suggests the immediate downtrend pressure may be easing. The RSI at 52.4 is in neutral territory, indicating neither overbought nor oversold conditions and leaving room for movement in either direction. Notably, the 24-hour volume of $17.65 million is healthy, suggesting continued trader interest. The current volatility reading of ~4.7% is moderate for crypto assets. For traders, the key level to watch is the $2.33-$2.34 confluence zone; a sustained break and close above could target a move toward $2.50. However, failure to hold above the 20-day SMA might see a retest of support near $2.26. A prudent strategy would be to wait for a confirmed breakout with volume before entering new long positions, using the 50-day SMA as a stop-loss guide for any bullish bets.

Key Metrics

| Price | 2.3400 USDT |

| 24h Change | 1.70% |

| 24h Volume | 17652107.29 |

| RSI(14) | 52.41 |

| SMA20 / SMA50 | 2.33 / 2.26 |

| Daily Volatility | 4.73% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).