Sentiment: Neutral

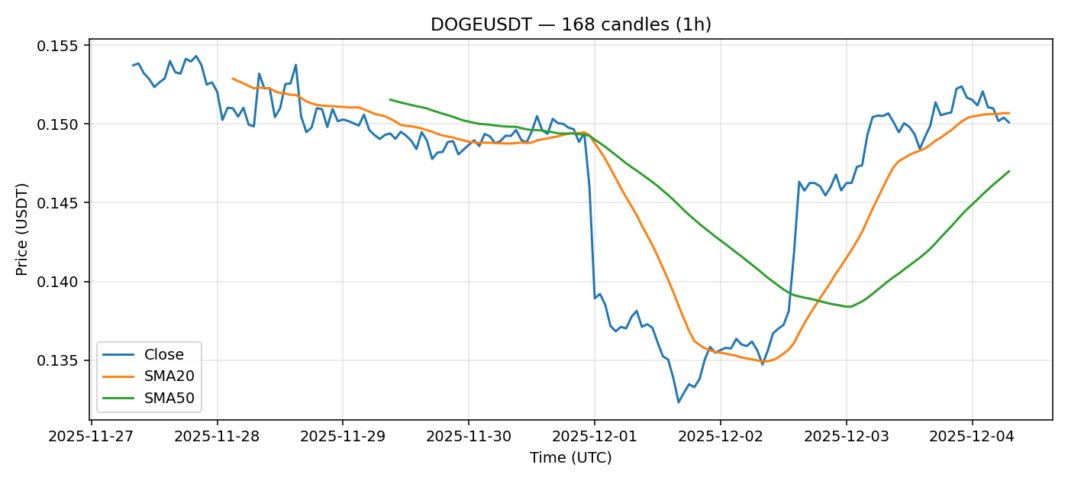

DOGE is consolidating around the $0.15 level after a 0.17% dip over the past 24 hours. The price currently sits just below the 20-day SMA ($0.15068) but remains above the more significant 50-day SMA ($0.14699), suggesting the medium-term uptrend structure is still intact despite short-term weakness. The RSI reading of 41 indicates the asset is approaching oversold territory but is not there yet, leaving room for further downside pressure. Trading volume remains robust at over $114 million, showing continued interest. The elevated volatility reading of 3.66% suggests traders should expect choppy price action. For active traders, a break and hold above the 20-day SMA could signal a return to bullish momentum, targeting a retest of recent highs. Conversely, a sustained break below the 50-day SMA would likely trigger deeper correction toward the $0.14 support zone. Position sizing should account for the heightened volatility.

Key Metrics

| Price | 0.1501 USDT |

| 24h Change | -0.17% |

| 24h Volume | 114355247.04 |

| RSI(14) | 41.06 |

| SMA20 / SMA50 | 0.15 / 0.15 |

| Daily Volatility | 3.66% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).