Sentiment: Neutral

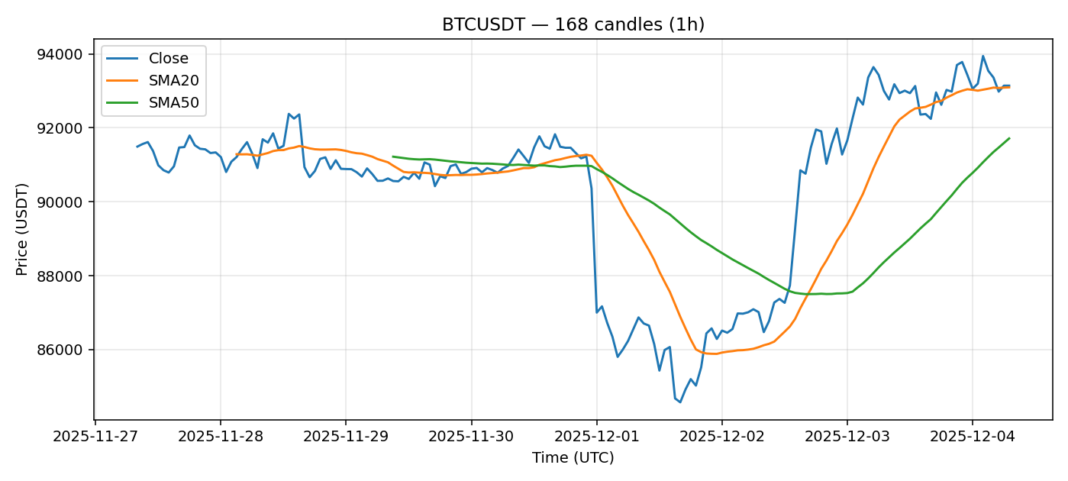

Bitcoin is consolidating around the $93,140 level after a minor 24-hour pullback of 0.31%. The key technical picture shows a market in equilibrium. The current price is trading almost exactly at the 20-day Simple Moving Average ($93,095), while holding comfortably above the more significant 50-day SMA ($91,712), suggesting the medium-term uptrend remains structurally intact. The RSI reading of 52 is firmly in neutral territory, indicating neither overbought nor oversold conditions and leaving ample room for movement in either direction. The elevated 24-hour volume of $2.25 billion confirms active participation at these levels. For traders, this represents a classic decision zone. A sustained hold above the 20-day SMA, especially on a closing basis, could see a retest of recent highs. However, a decisive break and close below the $91,700 (50 SMA) support would signal a deeper correction is likely. Risk management is paramount here; consider setting tight stops below the $91,500 level for long positions, while short-term traders might wait for a clearer directional break from this consolidation range.

Key Metrics

| Price | 93140.7500 USDT |

| 24h Change | -0.31% |

| 24h Volume | 2249005275.11 |

| RSI(14) | 52.14 |

| SMA20 / SMA50 | 93094.77 / 91712.16 |

| Daily Volatility | 2.63% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).