Sentiment: Bullish

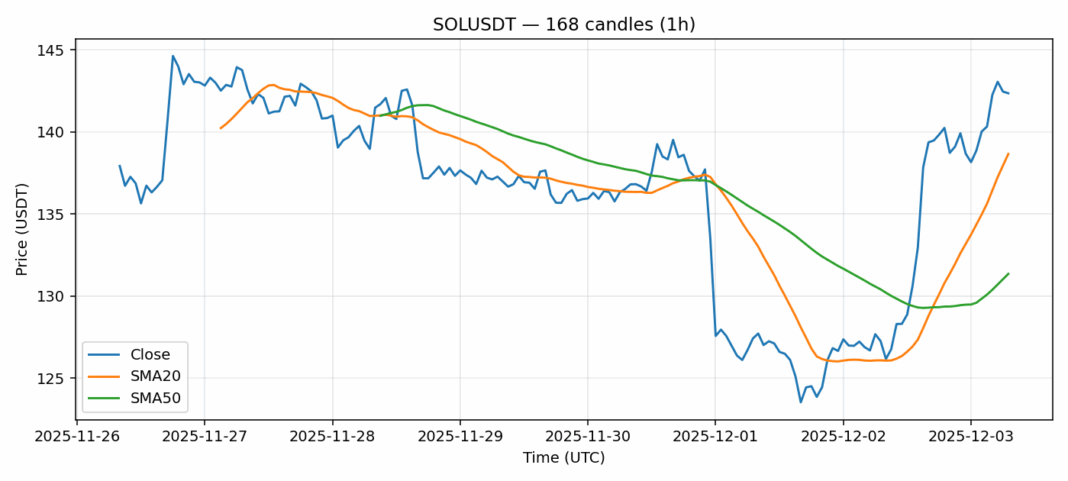

Solana (SOL) is showing robust momentum, trading at $142.37 with a significant 11.56% surge over the past 24 hours. This move is supported by substantial volume exceeding $762 million, indicating strong institutional and retail conviction. The price has decisively broken above both its 20-day SMA ($138.66) and 50-day SMA ($131.36), confirming a bullish trend structure. The RSI reading of 63.28 suggests the asset is approaching overbought territory but still has room to run before signaling exhaustion. The elevated volatility of 4.04% is characteristic of a trending market. For traders, the key support to watch is the $138-$140 zone, which now represents the new floor. A sustained hold above this level could target a retest of the $150 psychological resistance. Consider taking partial profits on any sharp extension toward $150, while using a break below $138 as a stop-loss signal for long positions. The momentum favors the bulls, but risk management is crucial in this volatile environment.

Key Metrics

| Price | 142.3700 USDT |

| 24h Change | 11.56% |

| 24h Volume | 762860416.42 |

| RSI(14) | 63.28 |

| SMA20 / SMA50 | 138.66 / 131.36 |

| Daily Volatility | 4.04% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).