Sentiment: Bullish

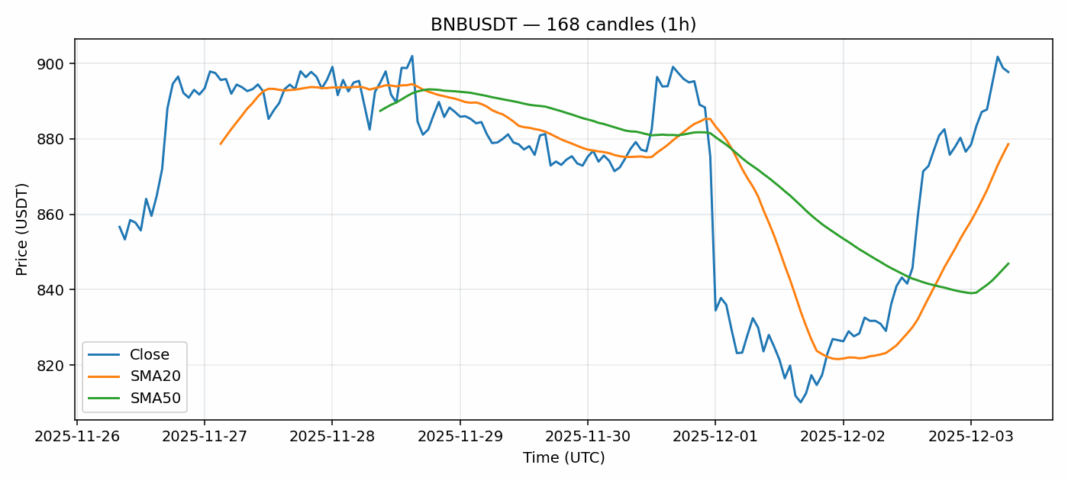

BNB has surged past the $897 level, posting a robust 8% gain over the past 24 hours on substantial volume exceeding $234 million. The rally has pushed the price decisively above both the 20-day SMA ($878.62) and 50-day SMA ($846.90), confirming a strong bullish trend structure. However, the RSI reading above 70 signals that the asset is entering overbought territory, which typically precedes a period of consolidation or a pullback. The elevated volatility reading of over 3% suggests traders should brace for sharp intraday moves. For traders, this presents a tactical challenge: the trend is clearly up, but the risk of a near-term correction is growing. Consider taking partial profits on existing long positions near current levels and waiting for a pullback toward the $878-$880 support zone (the 20-SMA) for a more favorable risk-reward entry for new longs. Strict stop-losses are advised below $870 to protect capital against a potential trend reversal fueled by profit-taking.

Key Metrics

| Price | 897.7600 USDT |

| 24h Change | 8.00% |

| 24h Volume | 234632611.78 |

| RSI(14) | 70.88 |

| SMA20 / SMA50 | 878.62 / 846.90 |

| Daily Volatility | 3.10% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).