Sentiment: Bearish

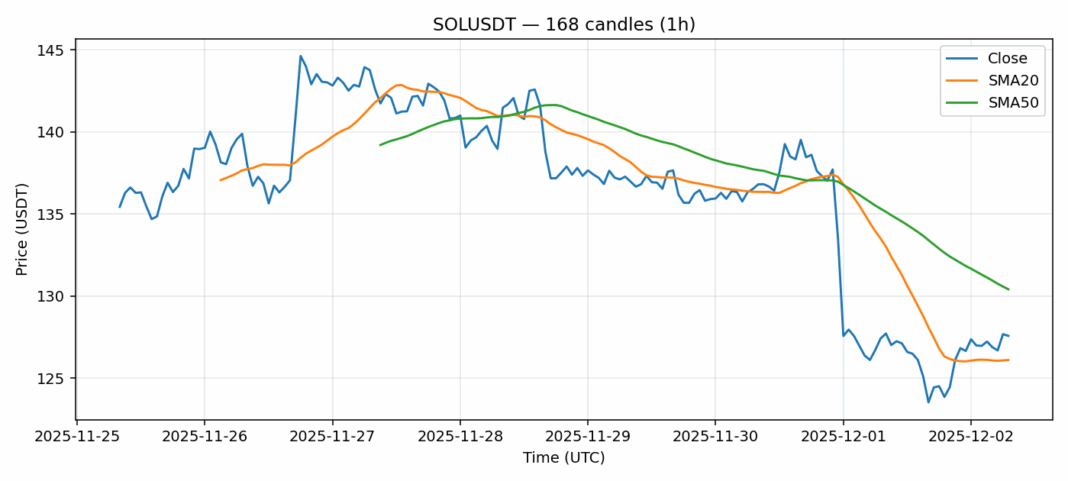

Solana (SOL) is trading at $127.58, showing modest 24-hour gains of 0.69% but facing significant technical headwinds. The current price sits just above the 20-day SMA ($126.10) but remains below the 50-day SMA ($130.42), indicating potential resistance overhead. The most concerning metric is the RSI reading of 72.89, which places SOL in overbought territory and suggests a near-term pullback is increasingly likely. While the 24-hour volume of $466 million demonstrates healthy market interest, the elevated volatility of 3.69% signals heightened uncertainty. Traders should exercise caution at these levels. Consider taking partial profits on long positions and wait for a retest of support near the $120-$122 zone before adding exposure. A decisive break above the 50-day SMA with volume confirmation would be needed to invalidate the current overbought warning and target higher resistance levels.

Key Metrics

| Price | 127.5800 USDT |

| 24h Change | 0.69% |

| 24h Volume | 466296790.10 |

| RSI(14) | 72.89 |

| SMA20 / SMA50 | 126.10 / 130.42 |

| Daily Volatility | 3.69% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).