Sentiment: Neutral

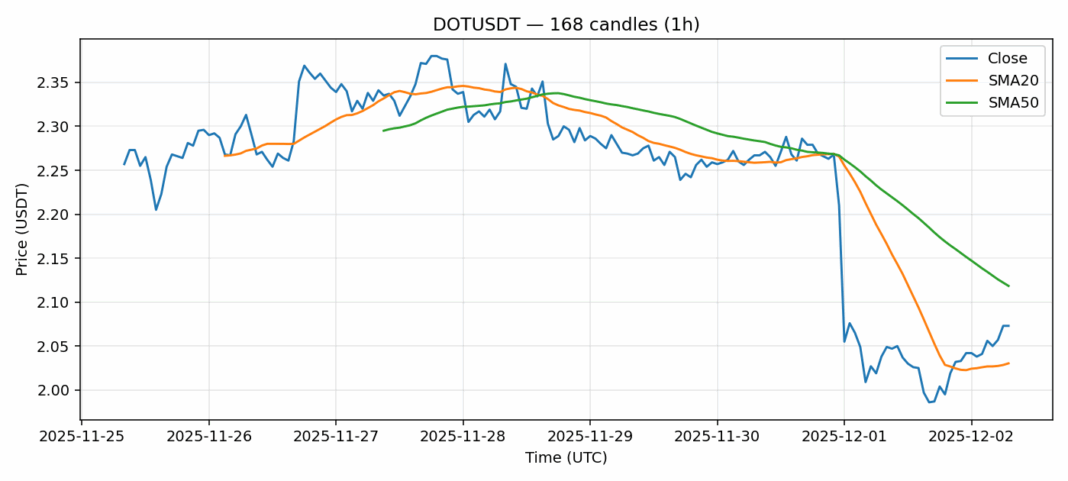

Polkadot (DOT) is showing significant strength against USDT, trading at $2.073 with a notable 2.52% gain over the past 24 hours. The price is currently positioned above its 20-day Simple Moving Average ($2.0303), indicating short-term bullish momentum, though it remains below the 50-day SMA ($2.11844), which could act as immediate resistance. The most critical technical indicator is the RSI reading of approximately 84.68, which is deep into overbought territory. This extreme level suggests the current rally may be overextended and due for a corrective pullback or consolidation. Trading volume of over $15.6 million is healthy, supporting the price move, but the elevated volatility of 4.4% warrants caution. For traders, this presents a classic risk-reward scenario. Aggressive traders might look for a break and close above the $2.12 resistance (50-day SMA) to target further upside, but the prudent strategy is to wait for the RSI to cool from its extreme levels. Consider taking partial profits on existing long positions and wait for a pullback towards the $2.03 support level for a better risk-adjusted entry. Avoid chasing the price at these elevated RSI readings.

Key Metrics

| Price | 2.0730 USDT |

| 24h Change | 2.52% |

| 24h Volume | 15666941.59 |

| RSI(14) | 84.68 |

| SMA20 / SMA50 | 2.03 / 2.12 |

| Daily Volatility | 4.40% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).