Sentiment: Neutral

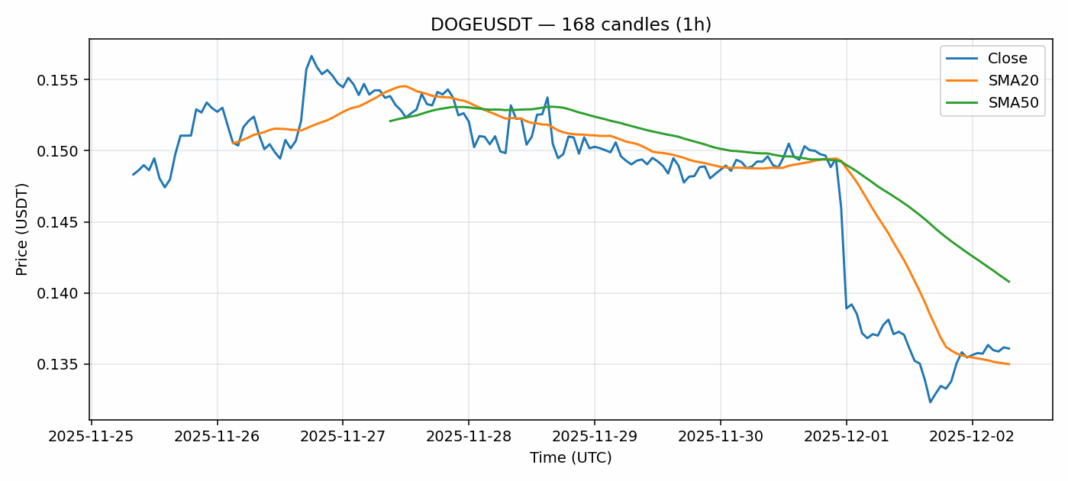

DOGE is consolidating around the $0.136 level after a recent pullback, showing a modest 24-hour decline of 0.66%. The key technical signal is the RSI reading of 79.12, which places the asset firmly in overbought territory and suggests a high probability of a near-term correction or consolidation phase. The current price is trading just above the 20-day SMA ($0.135), providing immediate support, but remains below the 50-day SMA ($0.141), which now acts as resistance. Trading volume remains substantial at over $100 million, indicating sustained interest, but the elevated volatility of 3.45% warns of potential sharp moves. For traders, this setup suggests caution. Aggressive long positions here are risky given the extreme RSI. A more prudent approach would be to wait for a pullback toward stronger support levels, or for the RSI to cool below 70, before considering new entries. Short-term traders might look for a break and close above the 50-day SMA as a signal for renewed bullish momentum, while a break below the 20-day SMA could trigger a deeper correction.

Key Metrics

| Price | 0.1361 USDT |

| 24h Change | -0.66% |

| 24h Volume | 100463461.32 |

| RSI(14) | 79.12 |

| SMA20 / SMA50 | 0.14 / 0.14 |

| Daily Volatility | 3.45% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).