Sentiment: Neutral

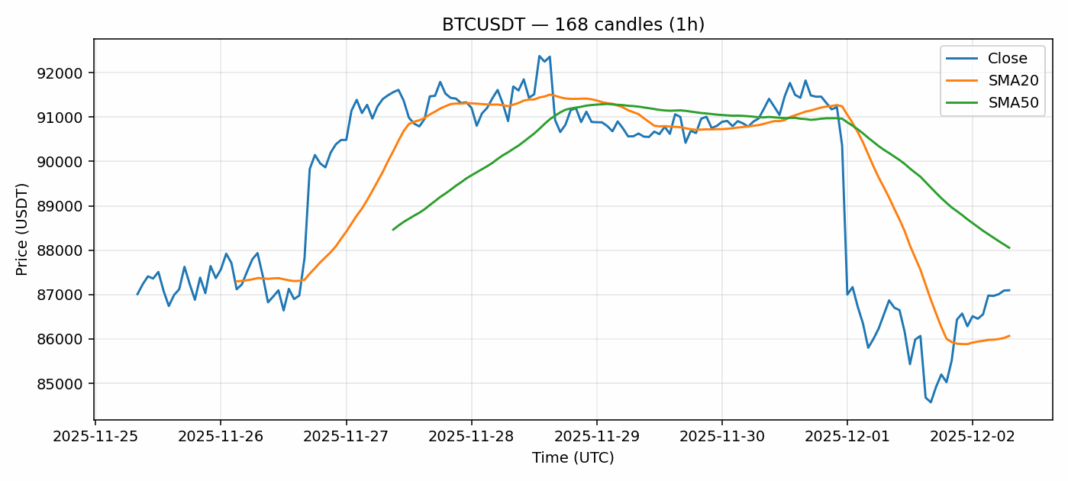

Bitcoin continues to defy gravity, pushing to $87,096 with nearly 1% daily gains on substantial $2.18B volume. The technical picture presents a classic conflict: momentum remains undeniably strong with price holding above the 20-day SMA ($86,068), but warning signs flash brightly. The RSI reading above 83 indicates severely overbought conditions rarely sustained for long periods. Meanwhile, the 50-day SMA at $88,056 now acts as immediate overhead resistance. This setup suggests consolidation is overdue. Traders should exercise extreme caution at these levels. Aggressive longs might consider taking partial profits, while new entries should wait for either a healthy pullback toward $84K-$85K support or a decisive break and hold above the 50-day SMA. The elevated volatility reading of 2.52% confirms this is not an environment for oversized positions. Risk management is paramount.

Key Metrics

| Price | 87096.5600 USDT |

| 24h Change | 0.99% |

| 24h Volume | 2176666842.65 |

| RSI(14) | 83.69 |

| SMA20 / SMA50 | 86067.89 / 88055.69 |

| Daily Volatility | 2.52% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).