Sentiment: Neutral

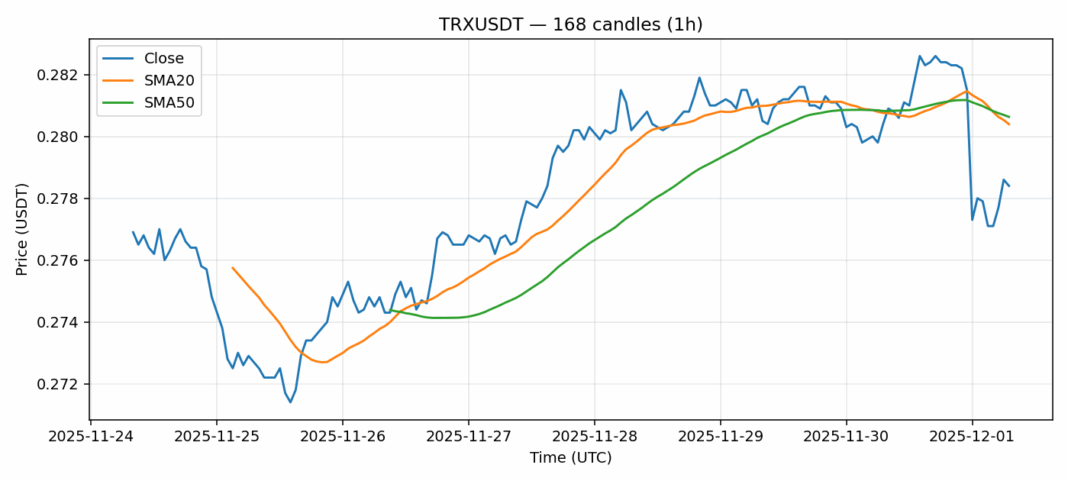

TRX/USDT is showing significant technical weakness after a 0.57% decline to $0.2784, with the price now trading below both its 20-day ($0.2804) and 50-day ($0.2806) simple moving averages. The critically oversold RSI reading of 25.58 suggests the selloff may be overextended in the near term, potentially setting up for a technical bounce. However, the high volatility reading of 0.95 indicates continued uncertainty, and the $0.28 level now acts as immediate resistance. Trading volume remains substantial at $75.5 million, showing continued market interest despite the downward pressure. For traders, this presents a potential contrarian opportunity: aggressive traders might consider scaling into long positions at these oversold levels with tight stops below $0.275, while conservative traders should wait for a confirmed break back above the SMA cluster before entering. The key will be whether TRX can reclaim the $0.28 psychological level in the coming sessions.

Key Metrics

| Price | 0.2784 USDT |

| 24h Change | -0.57% |

| 24h Volume | 75528894.83 |

| RSI(14) | 25.58 |

| SMA20 / SMA50 | 0.28 / 0.28 |

| Daily Volatility | 0.95% |

TRON — 1h candles, 7D window (SMA20/SMA50, RSI).