Sentiment: Bearish

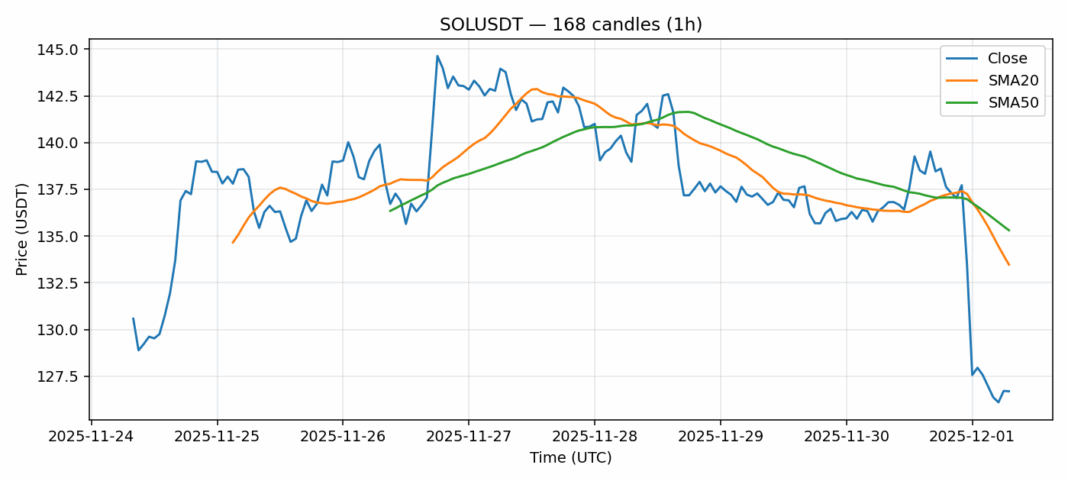

Solana (SOL) is experiencing significant technical distress, currently trading at $126.71 after a sharp 7.05% decline over the past 24 hours. The most alarming metric is the RSI reading of approximately 11.87, which indicates the asset is in deeply oversold territory—a level rarely seen and often preceding a technical bounce. However, price remains below both the 20-day SMA ($133.47) and 50-day SMA ($135.31), confirming the strong bearish trend structure. High volatility near 3.85% alongside substantial volume over $533 million suggests capitulatory selling is occurring. For traders, this presents a high-risk, high-reward scenario. Aggressive contrarians might consider scaling into a long position here, given the extreme RSI, but must use tight stops below recent lows. More conservative traders should wait for a confirmed reversal signal, such as a strong bullish engulfing candle on the daily chart or a reclaim of the 20-day SMA, before considering entries. The risk of further downside remains elevated until momentum shifts.

Key Metrics

| Price | 126.7100 USDT |

| 24h Change | -7.05% |

| 24h Volume | 533287139.62 |

| RSI(14) | 11.87 |

| SMA20 / SMA50 | 133.47 / 135.31 |

| Daily Volatility | 3.85% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).