Sentiment: Bearish

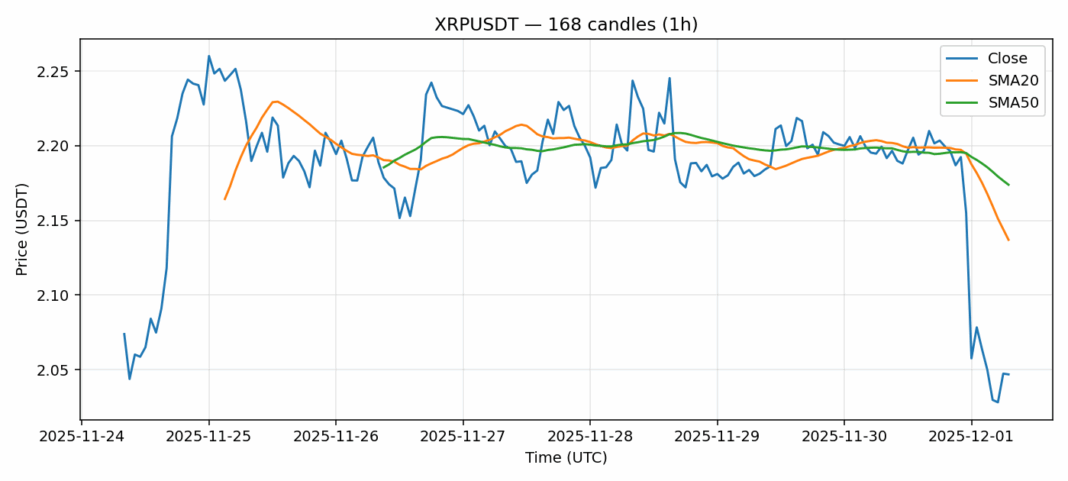

XRP/USDT is experiencing significant technical pressure, trading at $2.0469 after a sharp 6.7% decline over the past 24 hours. The most critical signal comes from the RSI reading of approximately 19, which indicates the asset is deeply oversold—a condition not seen often and typically preceding a potential relief rally or consolidation. Price has broken decisively below both the 20-day SMA ($2.137) and 50-day SMA ($2.174), confirming the near-term bearish structure. However, the substantial 24-hour volume of over $244 million suggests this move is being met with high participation, which could signal capitulation. For traders, this presents a high-risk, high-reward scenario. Aggressive contrarians might consider scaling into long positions here, using tight stops below recent lows, anticipating a mean reversion bounce toward the $2.13-$2.17 resistance zone. More conservative traders should wait for a confirmed bullish reversal pattern or a reclaiming of the 20-day SMA before entering, as volatility remains elevated at nearly 4%. The risk of further downside remains until key moving averages are recaptured.

Key Metrics

| Price | 2.0469 USDT |

| 24h Change | -6.70% |

| 24h Volume | 244424605.37 |

| RSI(14) | 19.00 |

| SMA20 / SMA50 | 2.14 / 2.17 |

| Daily Volatility | 3.91% |

Ripple — 1h candles, 7D window (SMA20/SMA50, RSI).