Sentiment: Bearish

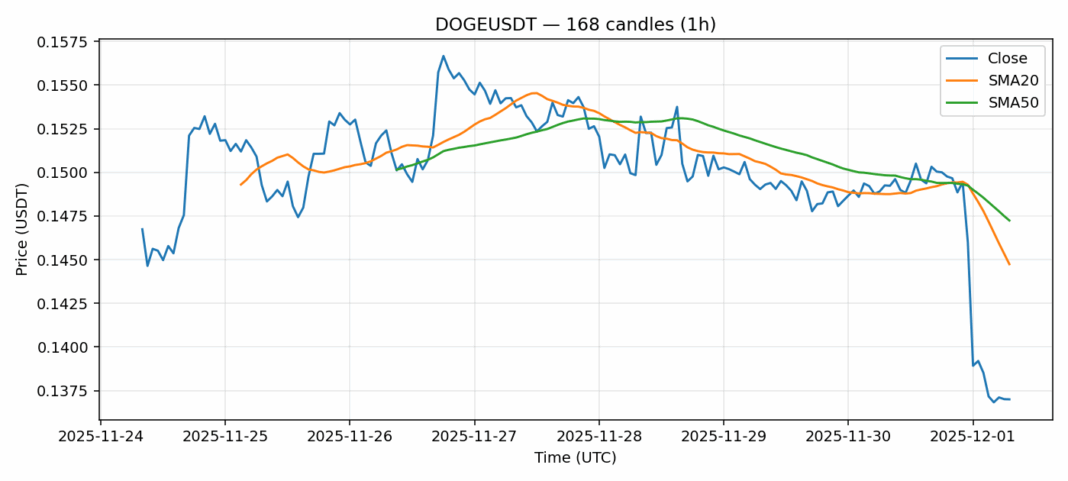

Dogecoin is experiencing significant technical distress, with the price of $0.137 representing a sharp 7.96% decline over the last 24 hours. The most alarming metric is the RSI reading of approximately 7.5, which indicates the asset is in deeply oversold territory, a condition rarely seen in major cryptocurrencies. While this extreme reading often precedes a technical bounce, the underlying trend remains decisively bearish, with the price trading well below both the 20-day SMA ($0.1447) and 50-day SMA ($0.1472). The high volatility reading of 3.68% confirms the market is in a state of panic. For traders, this presents a high-risk environment. Aggressive traders might look for a potential short-term relief rally from these oversold levels, but any long positions should be considered speculative with tight stop-losses. The prudent approach is to wait for a confirmed reversal pattern and a stabilization in volume, which remains elevated at nearly $119 million, before considering any meaningful long exposure. The path of least resistance remains downward until key moving averages are reclaimed.

Key Metrics

| Price | 0.1370 USDT |

| 24h Change | -7.96% |

| 24h Volume | 118824335.31 |

| RSI(14) | 7.50 |

| SMA20 / SMA50 | 0.14 / 0.15 |

| Daily Volatility | 3.68% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).