Sentiment: Neutral

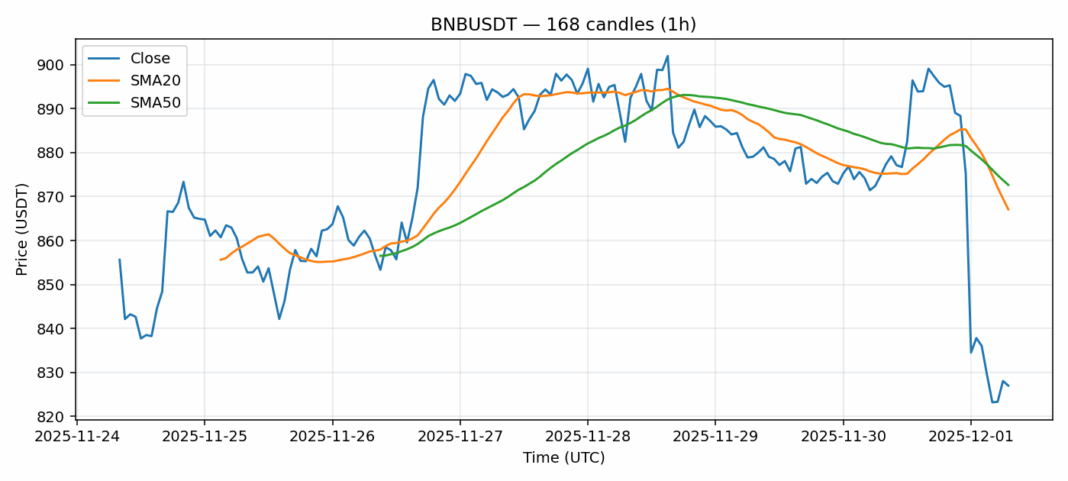

BNB is experiencing a severe technical breakdown, with the price of $826.97 now trading well below both its 20-day ($867.08) and 50-day ($872.66) Simple Moving Averages. The 24-hour decline of over 5% on substantial volume of $207 million signals strong selling pressure. The most alarming metric is the RSI reading of approximately 9.7, which indicates the asset is in deeply oversold territory—a condition rarely sustained for long periods. This extreme reading suggests panic selling may be nearing exhaustion. While the elevated volatility of 3.1% warns of continued sharp moves, the confluence of extreme oversold conditions and significant deviation from key moving averages presents a potential contrarian opportunity. Traders should watch for a bullish divergence on the RSI or a decisive break back above the $850 level as early signs of a relief rally. However, given the strong downtrend, any long positions should be considered speculative and managed with tight stop-losses below recent lows.

Key Metrics

| Price | 826.9700 USDT |

| 24h Change | -5.19% |

| 24h Volume | 207113377.14 |

| RSI(14) | 9.70 |

| SMA20 / SMA50 | 867.08 / 872.66 |

| Daily Volatility | 3.10% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).