Sentiment: Neutral

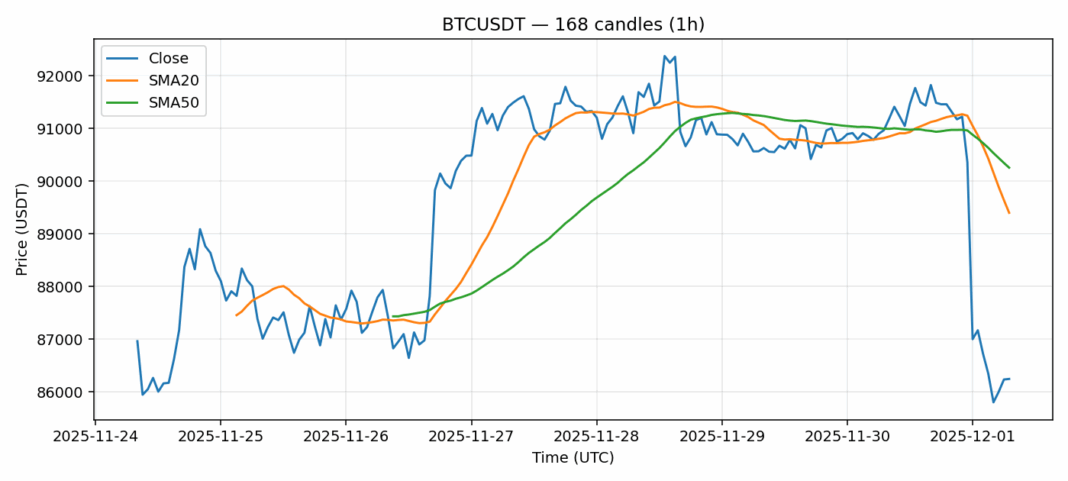

Bitcoin is experiencing a significant technical pullback, currently trading at $86,244 after a 5.12% decline over the past 24 hours. The most striking metric is the RSI reading of approximately 10, which indicates severely oversold conditions not seen in recent market cycles. Price has broken decisively below both the 20-day SMA ($89,400) and 50-day SMA ($90,256), suggesting a shift in short-to-medium-term momentum. However, the substantial 24-hour trading volume of $1.95 billion alongside elevated volatility points to intense capitulation rather than orderly distribution. For traders, this presents a high-risk, high-reward scenario. Aggressive traders might consider scaling into long positions at these levels with tight stops below recent lows, anticipating a technical bounce from extreme oversold readings. More conservative participants should wait for price to reclaim the 20-day SMA as confirmation of trend reversal. The current washout could establish a strong foundation for the next leg higher if support holds.

Key Metrics

| Price | 86244.6800 USDT |

| 24h Change | -5.12% |

| 24h Volume | 1951372475.24 |

| RSI(14) | 10.11 |

| SMA20 / SMA50 | 89400.11 / 90256.41 |

| Daily Volatility | 2.53% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).