Sentiment: Neutral

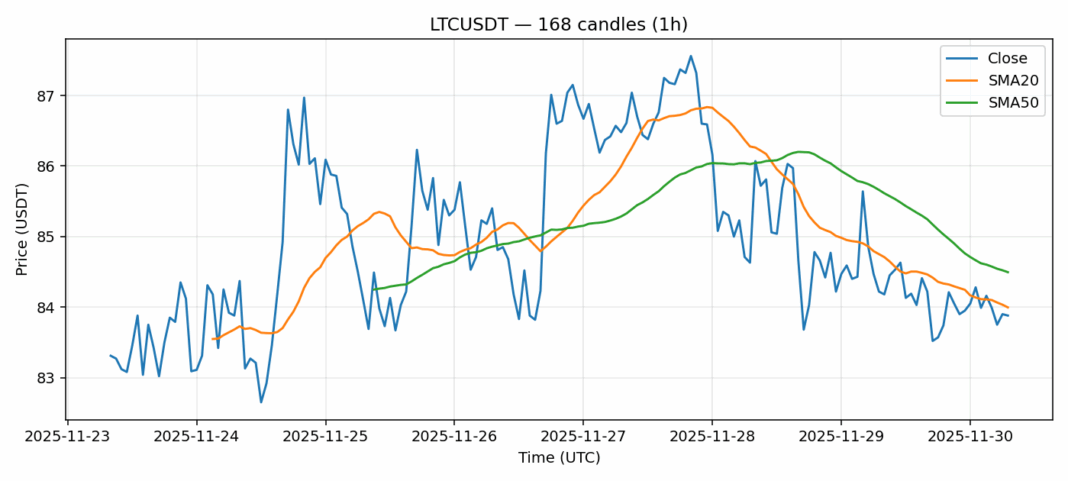

LTCUSDT is showing consolidation around the $83.88 level with minor 24-hour losses of -0.73%. The RSI at 57.4 indicates neutral momentum, neither overbought nor oversold, suggesting balanced market sentiment. Current price action sits just below both the 20-day SMA ($84.00) and 50-day SMA ($84.49), indicating potential resistance overhead. Trading volume of $13.4 million appears moderate but insufficient for a decisive breakout. Volatility remains contained at 3%, reflecting cautious market participation. For traders, watch for a confirmed break above the $84.50 SMA confluence with increased volume for long entries targeting $86-87. Downside protection should be placed below $82.50. The current setup favors range-bound trading until either support or resistance gives way. Accumulation on dips toward $82 could present favorable risk-reward opportunities given Litecoin’s established market position.

Key Metrics

| Price | 83.8800 USDT |

| 24h Change | -0.73% |

| 24h Volume | 13426376.64 |

| RSI(14) | 57.44 |

| SMA20 / SMA50 | 84.00 / 84.49 |

| Daily Volatility | 3.01% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).