Sentiment: Neutral

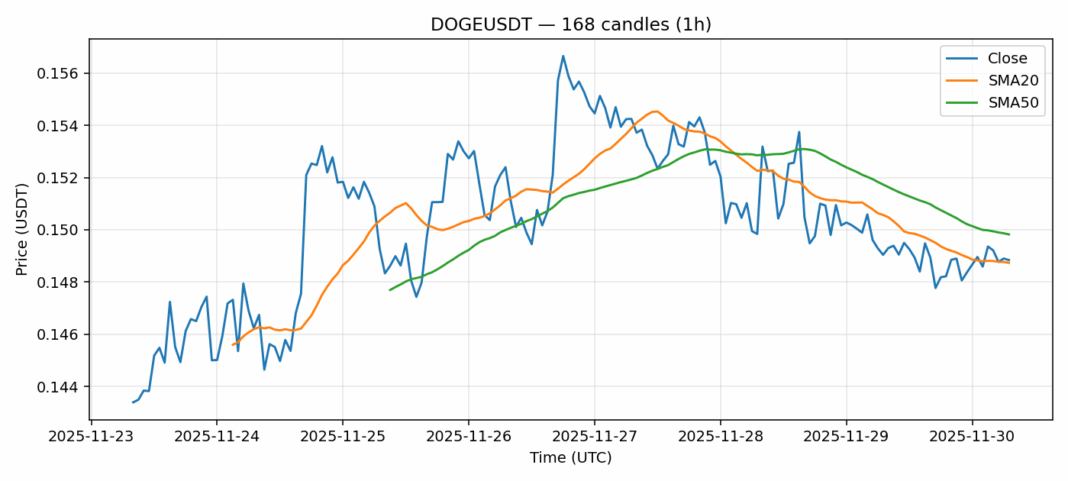

DOGE is showing consolidation around the $0.149 level with mixed technical signals. The current price sits just above the 20-day SMA at $0.1487 but remains below the 50-day SMA at $0.1498, indicating near-term neutrality with slight bearish pressure. The 24-hour decline of 0.3% reflects cautious sentiment, though trading volume remains healthy at over $41 million. The RSI reading of 61 suggests DOGE is approaching overbought territory but hasn’t crossed the critical 70 threshold yet. Volatility at 3.3% indicates typical meme coin behavior, though less extreme than historical moves. For traders, consider waiting for a decisive break above the 50-day SMA for long entries with targets at $0.155. Downside protection should be placed below $0.145. Given the tight range between moving averages, range-bound strategies could capitalize on volatility spikes while directional traders should await clearer momentum signals.

Key Metrics

| Price | 0.1488 USDT |

| 24h Change | -0.31% |

| 24h Volume | 41007515.73 |

| RSI(14) | 61.17 |

| SMA20 / SMA50 | 0.15 / 0.15 |

| Daily Volatility | 3.32% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).