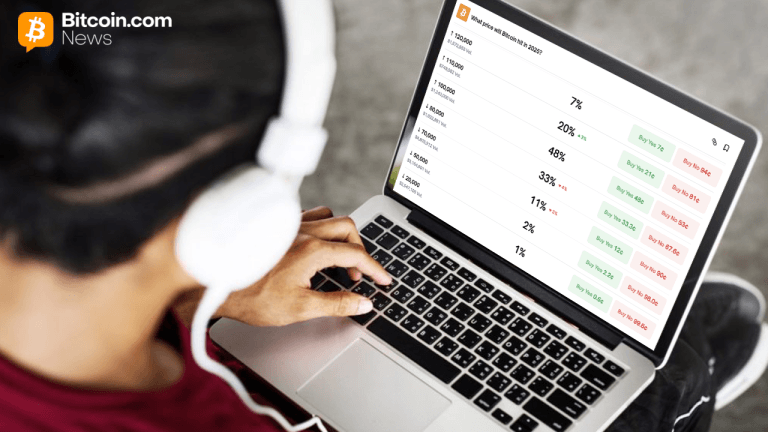

As of November 30, 2025, Bitcoin maintains a trading position of $91,482, with leading prediction platforms Polymarket and Kalshi presenting calibrated assessments regarding its potential to breach the $100,000 threshold before year-end. Market participants demonstrate measured optimism through carefully balanced wagers, reflecting sophisticated risk evaluation rather than speculative exuberance.

With merely weeks remaining in the trading calendar, these prediction markets have evolved into crucial barometers for institutional and retail sentiment alike. The platforms’ aggregated probabilities reveal nuanced market expectations, where substantial upside potential exists alongside recognition of significant resistance levels.

Polymarket’s contract specifications indicate traders anticipate possible appreciation while maintaining realistic parameters for Bitcoin’s performance. Similarly, Kalshi’s structured markets demonstrate sophisticated position-taking that acknowledges both bullish catalysts and potential headwinds. The convergence of these probability-based assessments provides valuable insight into market psychology during this critical period.

These prediction mechanisms have matured into essential tools for gauging cryptocurrency market expectations, offering transparent, real-time sentiment indicators that complement traditional analytical approaches. As 2025 approaches its conclusion, the evolving odds structure continues to provide market participants with dynamic probabilistic frameworks for strategic positioning.