Sentiment: Neutral

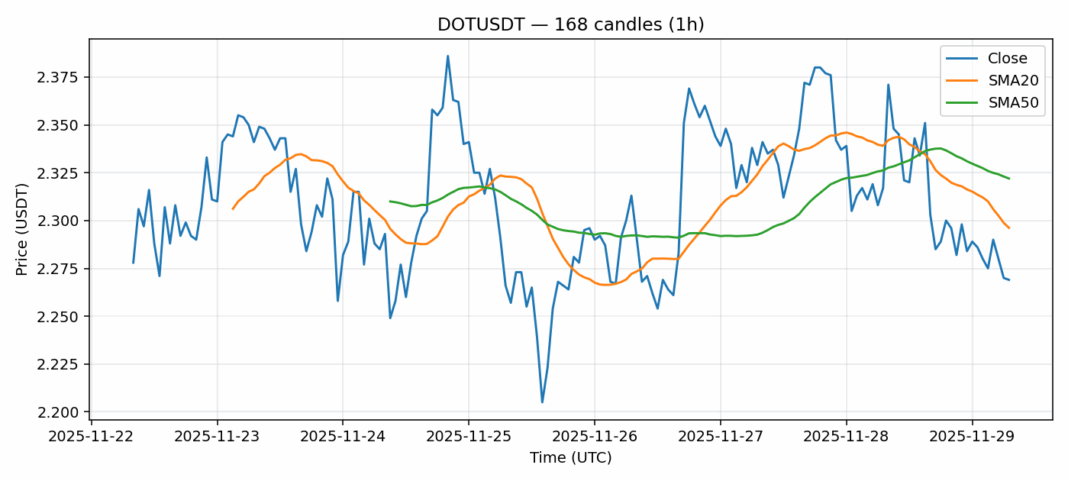

DOT is showing signs of consolidation after a minor 1.8% pullback over the past 24 hours, currently trading at $2.269. The price sits below both the 20-day SMA ($2.296) and 50-day SMA ($2.322), indicating near-term bearish pressure, though the RSI at 43 suggests we’re approaching oversold territory without being extreme. Trading volume remains healthy at over $10 million, providing adequate liquidity for position entries. The 3.8% volatility reading suggests moderate price swings are likely in the coming sessions. For traders, consider accumulating near current levels with tight stops below $2.20, targeting a retest of the 20-day SMA resistance. Longer-term holders might view this as a potential accumulation zone given Polkadot’s fundamental strength in the parachain ecosystem. Risk management remains crucial given the broader market uncertainty.

Key Metrics

| Price | 2.2690 USDT |

| 24h Change | -1.82% |

| 24h Volume | 10037678.08 |

| RSI(14) | 43.22 |

| SMA20 / SMA50 | 2.30 / 2.32 |

| Daily Volatility | 3.83% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).