Sentiment: Bullish

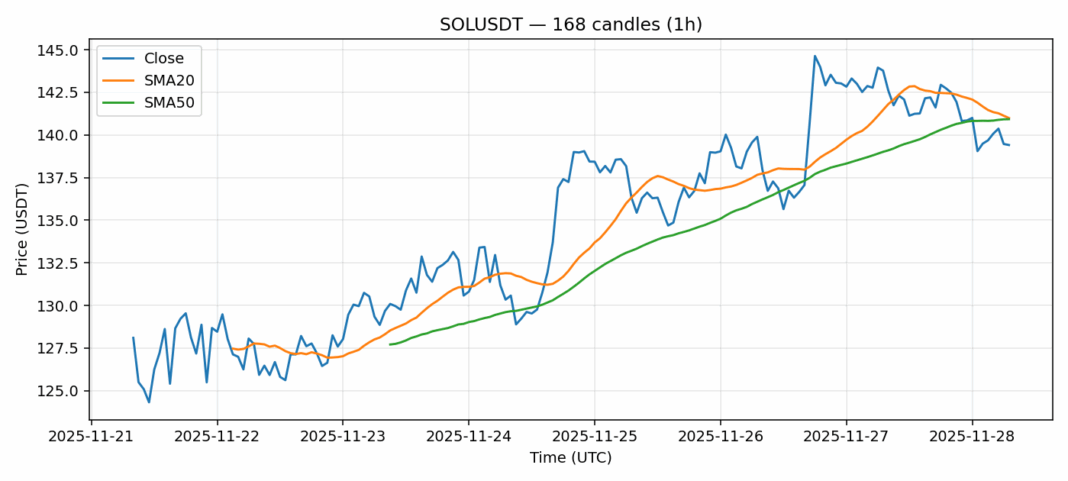

SOL is currently trading at $139.41, showing a modest 3.15% decline over the past 24 hours amid broader market uncertainty. The technical picture reveals several compelling signals for traders. With RSI sitting at 36, SOL has entered oversold territory, suggesting potential for a near-term bounce. The price is trading just below both the 20-day SMA ($140.99) and 50-day SMA ($140.92), indicating consolidation around key moving average support. The 24-hour trading volume of $332 million demonstrates healthy liquidity, while the 4.2% volatility reading suggests relatively stable price action compared to typical crypto swings. For traders, current levels present an attractive risk-reward setup for long positions with tight stops below $135. A break above the $141 SMA confluence could trigger momentum toward $150 resistance. However, traders should monitor broader market sentiment as SOL remains vulnerable to sector-wide pressures.

Key Metrics

| Price | 139.4100 USDT |

| 24h Change | -3.15% |

| 24h Volume | 332029103.29 |

| RSI(14) | 36.01 |

| SMA20 / SMA50 | 140.99 / 140.92 |

| Daily Volatility | 4.20% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).