Sentiment: Bullish

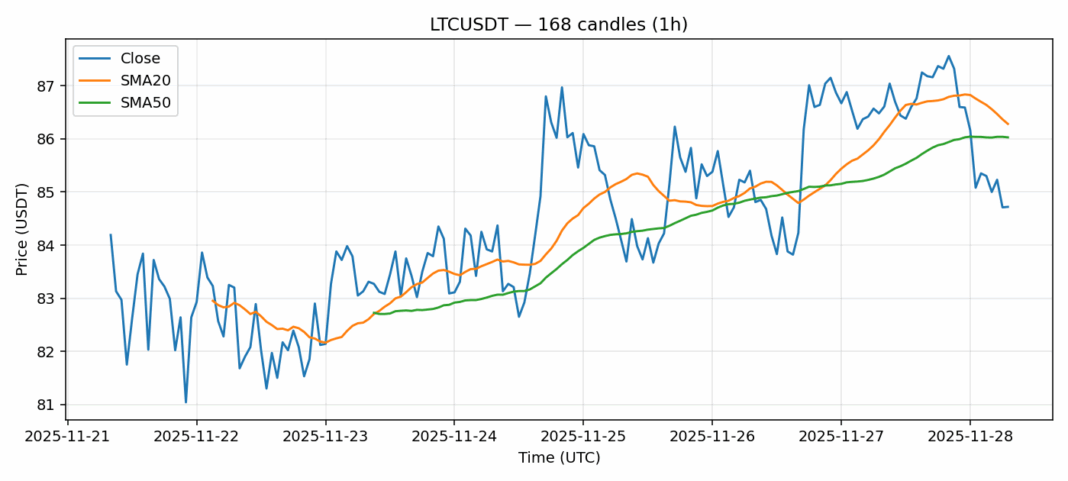

Litecoin is showing clear signs of being oversold with its RSI plunging to 22 – levels not seen since major capitulation events. While the 24-hour price decline of 2.14% appears concerning, the current price of $84.72 sits below both the 20-day ($86.28) and 50-day ($86.03) SMAs, suggesting potential undervaluation. Trading volume remains healthy at $25.6 million, indicating sustained interest despite the downturn. The elevated volatility reading of 3.63% presents both risk and opportunity for swing traders. For position traders, this represents a compelling accumulation zone with tight stop losses below $82. Day traders should watch for RSI reversal patterns and volume spikes as potential entry signals. The convergence of technical indicators points to a likely relief rally, though sustained momentum will require breaking back above the $86 resistance cluster.

Key Metrics

| Price | 84.7200 USDT |

| 24h Change | -2.14% |

| 24h Volume | 25585238.31 |

| RSI(14) | 22.02 |

| SMA20 / SMA50 | 86.28 / 86.03 |

| Daily Volatility | 3.63% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).