Sentiment: Bullish

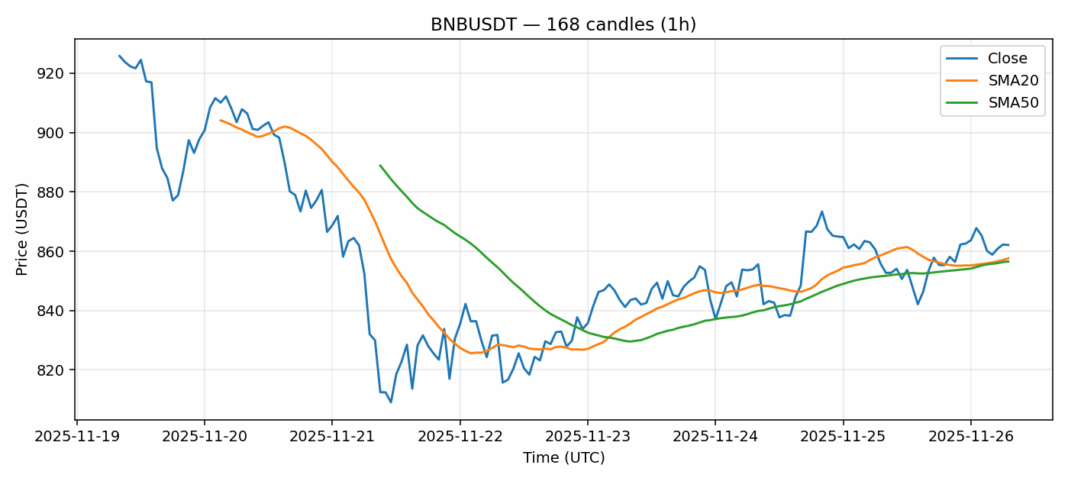

BNB is showing constructive technical positioning as it trades at $862.09, holding firmly above both the 20-day SMA ($857.60) and 50-day SMA ($856.50). The 2.42% gain over the past 24 hours comes alongside robust trading volume of nearly $120 million, indicating genuine institutional interest rather than speculative froth. With RSI at 56.88, BNB maintains healthy momentum without entering overbought territory, suggesting room for further upside. The current volatility reading of 3.5% reflects typical market conditions for a major altcoin. Traders should consider accumulating on any dips toward the $855-860 support zone, which represents the convergence of key moving averages. A decisive break above $870 could trigger momentum buying toward the $900 psychological level. Maintain stop-losses around $845 to protect against any unexpected market-wide sell-offs.

Key Metrics

| Price | 862.0900 USDT |

| 24h Change | 0.24% |

| 24h Volume | 119643557.42 |

| RSI(14) | 56.88 |

| SMA20 / SMA50 | 857.60 / 856.50 |

| Daily Volatility | 3.50% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).