Sentiment: Bullish

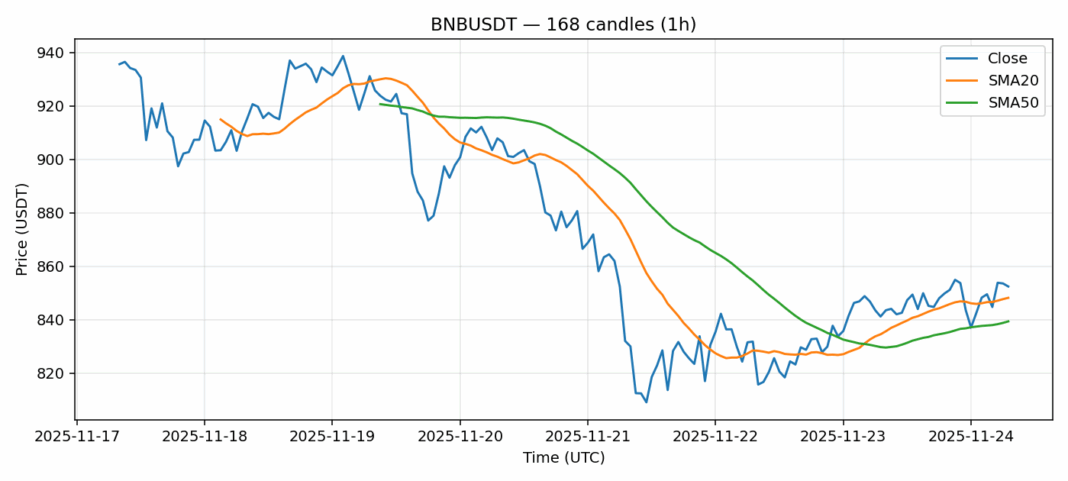

BNB is showing constructive technical positioning as it trades at $852.42, holding firmly above both its 20-day SMA ($848.18) and 50-day SMA ($839.36). The 1.1% gain over the past 24 hours, coupled with healthy volume of $153 million, suggests accumulation is occurring at these levels. The RSI reading of 56.89 indicates neither overbought nor oversold conditions, leaving ample room for further upside. With volatility sitting at 3.7%, BNB appears to be in a consolidation phase before its next directional move. Traders should watch for a sustained break above $860, which could trigger momentum toward the $880 resistance zone. Support remains strong at the $840-$845 confluence of moving averages. Position sizing should remain moderate given the current volatility environment, with stop losses ideally placed below $835 for long positions.

Key Metrics

| Price | 852.4200 USDT |

| 24h Change | 1.10% |

| 24h Volume | 152995435.71 |

| RSI(14) | 56.89 |

| SMA20 / SMA50 | 848.18 / 839.36 |

| Daily Volatility | 3.70% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).