Sentiment: Neutral

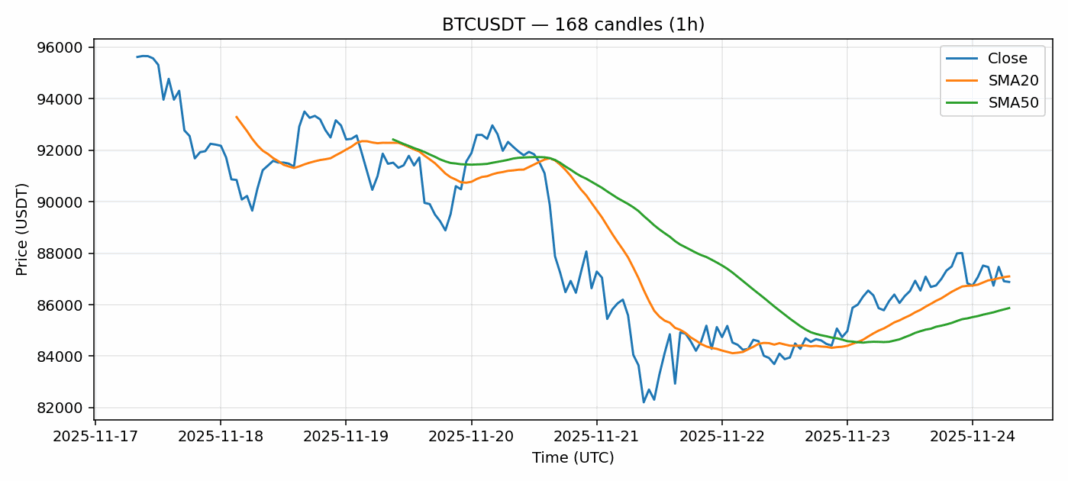

Bitcoin is consolidating around the $86,800 level after a modest 1.19% gain over the past 24 hours. The current price action shows BTC trading just below its 20-day simple moving average at $87,097, while maintaining support above the 50-day SMA at $85,867. This positioning suggests the market is in a delicate equilibrium between bullish and bearish forces. The RSI reading of 51.25 indicates neutral momentum, neither overbought nor oversold, providing room for movement in either direction. Trading volume remains robust at $1.76 billion, showing sustained institutional interest despite recent volatility of 3.46%. Traders should watch for a decisive break above $87,100 resistance or below $85,800 support for directional clarity. Current conditions favor range-bound strategies with tight stop-losses until clearer momentum emerges. Consider accumulating on dips toward the 50-SMA while maintaining cautious exposure given the elevated volatility environment.

Key Metrics

| Price | 86887.6300 USDT |

| 24h Change | 1.19% |

| 24h Volume | 1764643009.27 |

| RSI(14) | 51.25 |

| SMA20 / SMA50 | 87097.07 / 85867.29 |

| Daily Volatility | 3.46% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).