Sentiment: Neutral

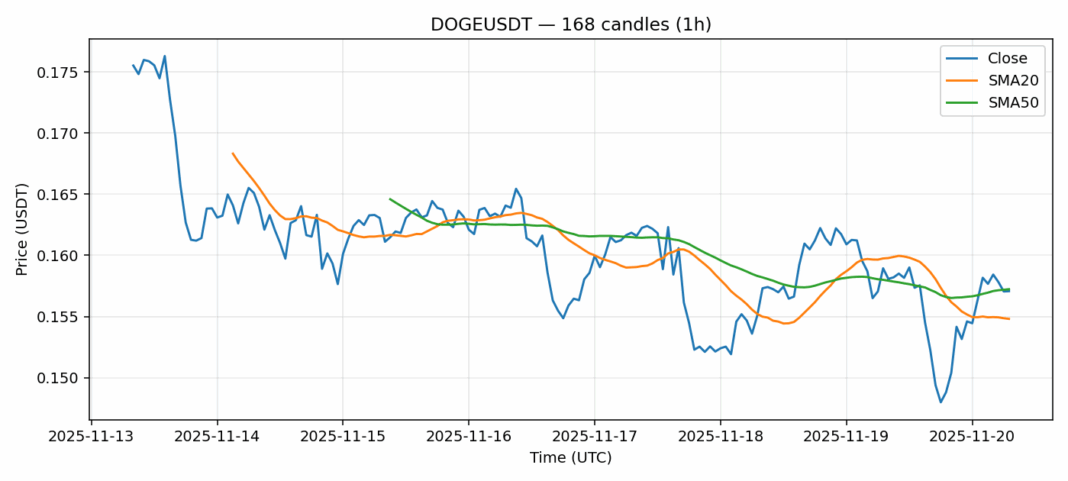

DOGE is showing mixed signals as it trades at $0.157, clinging to the critical 20-day SMA support at $0.1548 while testing resistance near the 50-day SMA at $0.1572. The 24-hour gain of 0.006 points to tentative bullish momentum, but the elevated RSI of 73.2 indicates significant overbought conditions that could trigger a near-term pullback. Trading volume remains robust at $208M, suggesting sustained market interest, though the 4.5% volatility underscores DOGE’s characteristic price swings. Traders should watch for a decisive break above the 50-day SMA for continuation toward $0.162, while failure to hold $0.154 could see a retest of $0.148 support. Position sizing remains crucial given DOGE’s volatility – consider scaling into positions rather than full allocations.

Key Metrics

| Price | 0.1571 USDT |

| 24h Change | 0.01% |

| 24h Volume | 208844825.50 |

| RSI(14) | 73.22 |

| SMA20 / SMA50 | 0.15 / 0.16 |

| Daily Volatility | 4.54% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).