Sentiment: Bullish

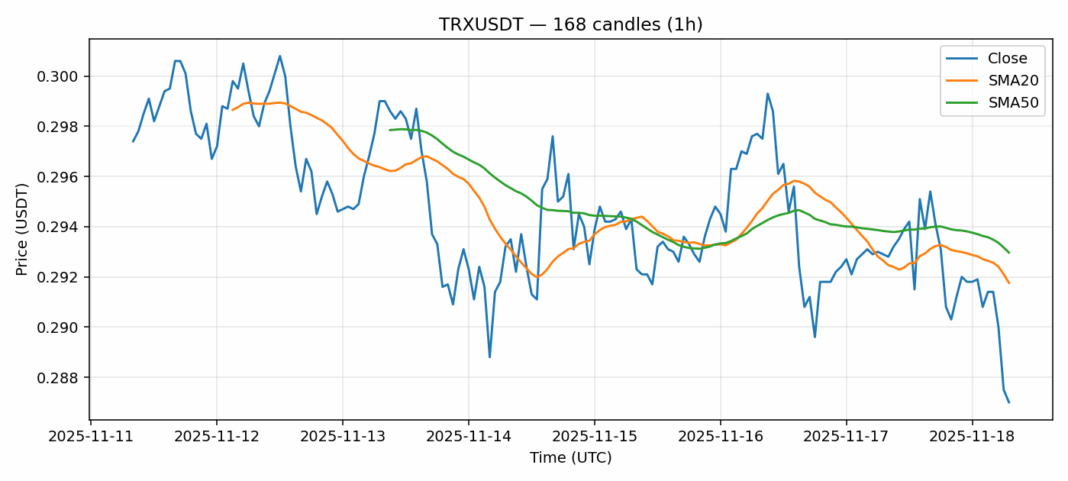

TRXUSDT is showing intriguing technical signals after a 2.08% decline to $0.287. The RSI reading of 20.17 indicates severely oversold conditions, typically preceding potential bullish reversals. Current price sits below both the 20-day SMA ($0.29176) and 50-day SMA ($0.29297), suggesting short-term bearish momentum, but the significant deviation from moving averages creates attractive entry opportunities. Trading volume remains robust at $162 million, providing adequate liquidity for position adjustments. The low volatility reading of 1.95% suggests consolidation may be underway. For traders, consider scaling into long positions with tight stop-losses below $0.285, targeting resistance near the 20-day SMA. Risk management is crucial given the oversold bounce could be temporary. Accumulation around current levels appears favorable for swing traders anticipating mean reversion.

Key Metrics

| Price | 0.2870 USDT |

| 24h Change | -2.08% |

| 24h Volume | 162185204.46 |

| RSI(14) | 20.17 |

| SMA20 / SMA50 | 0.29 / 0.29 |

| Daily Volatility | 1.95% |

TRON — 1h candles, 7D window (SMA20/SMA50, RSI).