Sentiment: Neutral

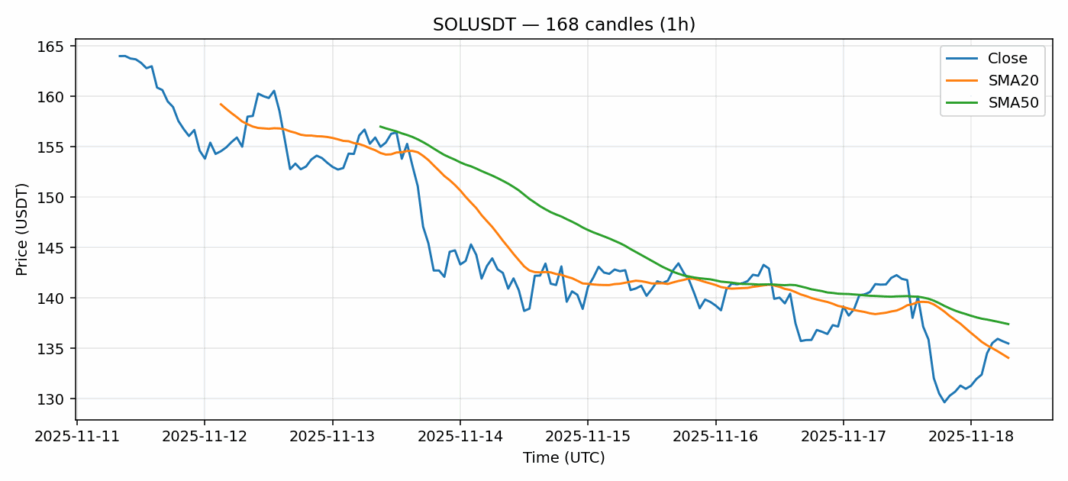

SOL is showing mixed signals after a 4.2% pullback to $135.49. Despite the daily decline, trading volume remains robust at $944M, indicating sustained institutional interest. The RSI at 67.6 suggests SOL is approaching overbought territory but hasn’t crossed the critical 70 threshold yet. Currently trading above the 20-day SMA ($134.07) but below the 50-day SMA ($137.41), SOL appears to be consolidating within a tight range. The 4.45% volatility reading reflects typical altcoin behavior amid current market conditions. Traders should watch for a decisive break above $137.50 resistance or below $134 support for directional clarity. Consider scaling into positions on dips toward $130 with stops below $125, while taking partial profits near $140-142 resistance. The overall structure remains constructive despite near-term pressure.

Key Metrics

| Price | 135.4900 USDT |

| 24h Change | -4.21% |

| 24h Volume | 944256080.27 |

| RSI(14) | 67.62 |

| SMA20 / SMA50 | 134.07 / 137.41 |

| Daily Volatility | 4.45% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).