Sentiment: Bearish

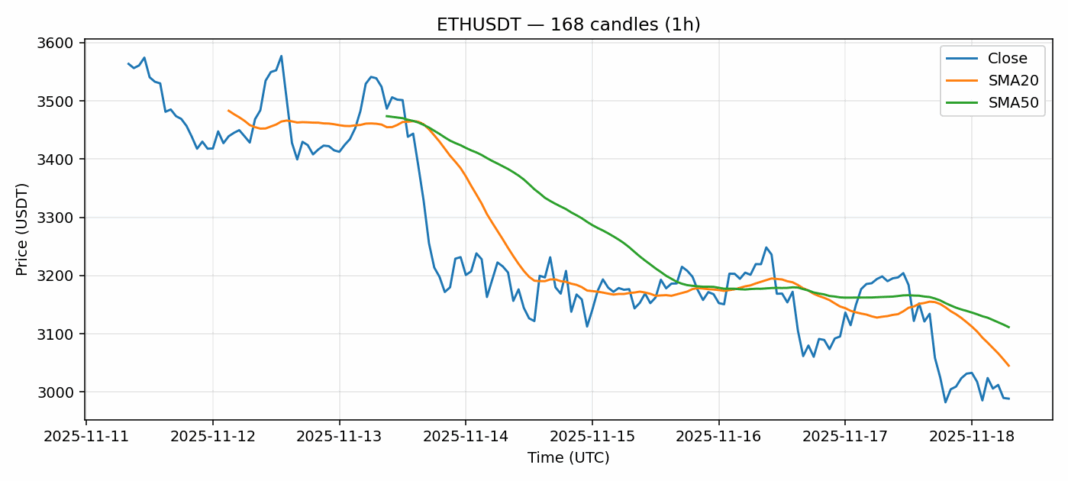

Ethereum faces significant selling pressure as ETH/USDT trades at $2,989, down 6.47% over 24 hours with elevated volatility at 4.25%. The current price sits below both the 20-day SMA ($3,045) and 50-day SMA ($3,111), indicating sustained bearish momentum. However, the RSI reading of 36.57 suggests ETH is approaching oversold territory, potentially setting up for a near-term bounce. Trading volume remains substantial at $2.87B, reflecting active participation despite the downturn. Traders should watch for consolidation around the $2,950-$3,000 support zone. Consider scaling into long positions cautiously if RSI dips below 30, with tight stops below $2,900. Short-term traders might find opportunities in volatility plays, but the broader trend remains cautious until ETH reclaims the $3,100 resistance level. Market sentiment appears shaken, but oversold conditions could present strategic entry points for patient investors.

Key Metrics

| Price | 2988.9700 USDT |

| 24h Change | -6.47% |

| 24h Volume | 2876428638.13 |

| RSI(14) | 36.57 |

| SMA20 / SMA50 | 3045.21 / 3111.37 |

| Daily Volatility | 4.25% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).