Sentiment: Neutral

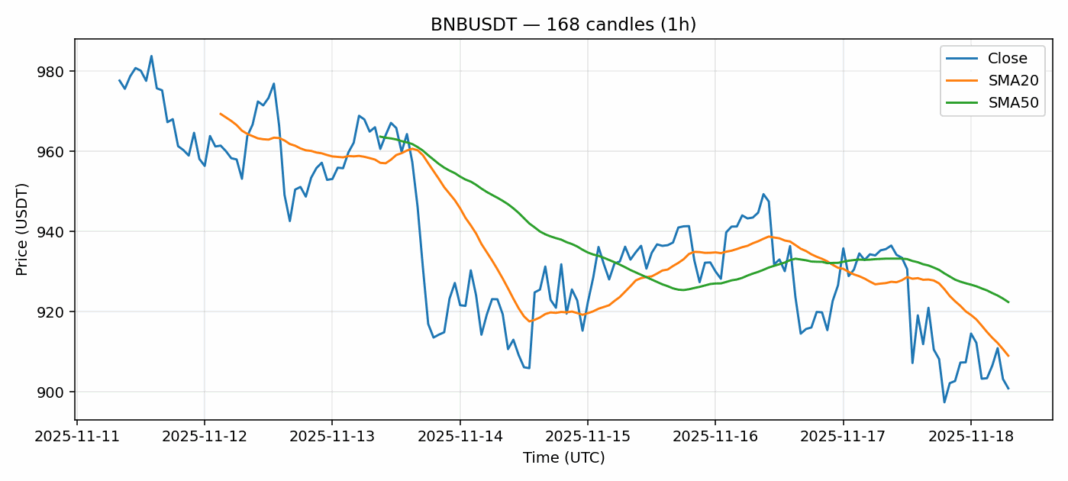

BNB is showing signs of consolidation near the $900 level, down 3.6% over the past 24 hours amid elevated trading volumes exceeding $401 million. The current RSI reading of 41.8 indicates oversold conditions, suggesting potential for a near-term bounce. However, BNB continues trading below both its 20-day SMA ($909) and 50-day SMA ($922), confirming the short-term bearish momentum. The 3.16% volatility reading reflects moderate price swings typical during consolidation phases. Traders should watch for a decisive break above the $922 resistance level for confirmation of trend reversal. Until then, consider scaling into positions cautiously around current levels with tight stop-losses below $880. The high volume during this decline suggests institutional interest, potentially creating a solid foundation for recovery once market sentiment improves. Range-bound trading between $880-$920 appears likely in the immediate term.

Key Metrics

| Price | 900.8700 USDT |

| 24h Change | -3.59% |

| 24h Volume | 401275172.26 |

| RSI(14) | 41.83 |

| SMA20 / SMA50 | 909.01 / 922.40 |

| Daily Volatility | 3.16% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).