Sentiment: Bearish

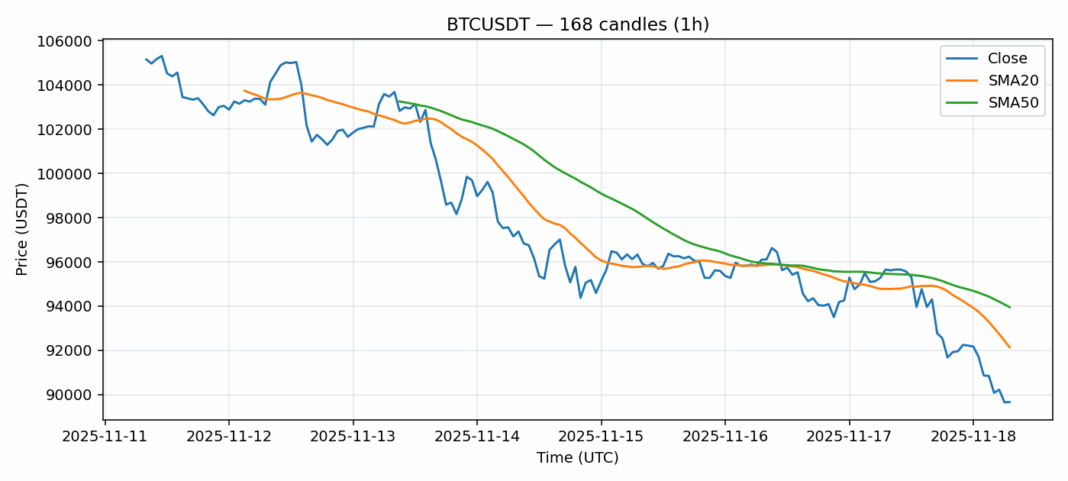

Bitcoin is experiencing significant technical pressure as it trades at $89,659, down nearly 6% over the past 24 hours. The most striking development is the RSI reading of 15.78, which represents deeply oversold territory not seen in recent market cycles. While this typically signals potential for a sharp rebound, traders should exercise caution as price remains below both the 20-day SMA ($92,142) and 50-day SMA ($93,954), confirming the bearish momentum. The elevated volatility at 2.64% suggests continued price swings ahead. For position traders, this could present accumulation opportunities near key support levels, though strict risk management is essential given the current downtrend. Day traders should watch for potential short squeezes given the extreme oversold conditions, but wait for confirmation of reversal patterns before entering long positions. The substantial $4.56 billion trading volume indicates institutional participation in this move.

Key Metrics

| Price | 89659.8500 USDT |

| 24h Change | -5.90% |

| 24h Volume | 4560320306.68 |

| RSI(14) | 15.78 |

| SMA20 / SMA50 | 92142.64 / 93954.49 |

| Daily Volatility | 2.64% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).