Sentiment: Bearish

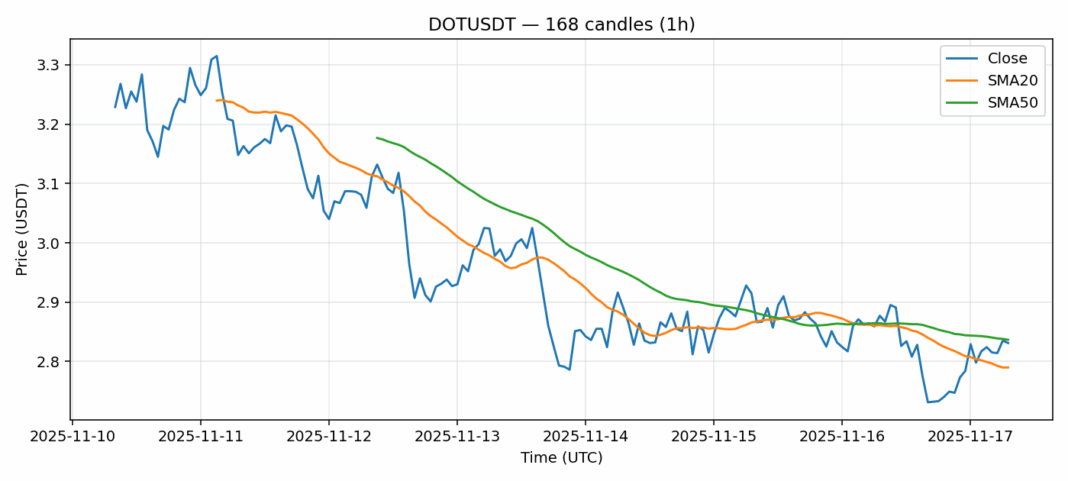

DOT is showing concerning technical signals despite holding above key support levels. The token trades at $2.831, down 1.08% over 24 hours, while displaying an extremely overbought RSI reading of 75.65. This divergence between price action and momentum indicators suggests potential exhaustion in the recent rally. Volume remains healthy at $17.5 million, but the high volatility reading of 4.94% indicates significant price swings. The 20-day SMA at $2.79 provides immediate support, while the 50-day SMA at $2.84 acts as resistance. Traders should exercise caution here – the overbought RSI combined with resistance at the 50-day moving average creates a high-risk environment. Consider taking partial profits if long, and wait for either a healthy pullback to the $2.75-$2.78 support zone or a decisive break above $2.85 with volume confirmation before establishing new positions. Risk management is crucial given the elevated volatility.

Key Metrics

| Price | 2.8310 USDT |

| 24h Change | -1.08% |

| 24h Volume | 17568695.96 |

| RSI(14) | 75.65 |

| SMA20 / SMA50 | 2.79 / 2.84 |

| Daily Volatility | 4.94% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).