Sentiment: Neutral

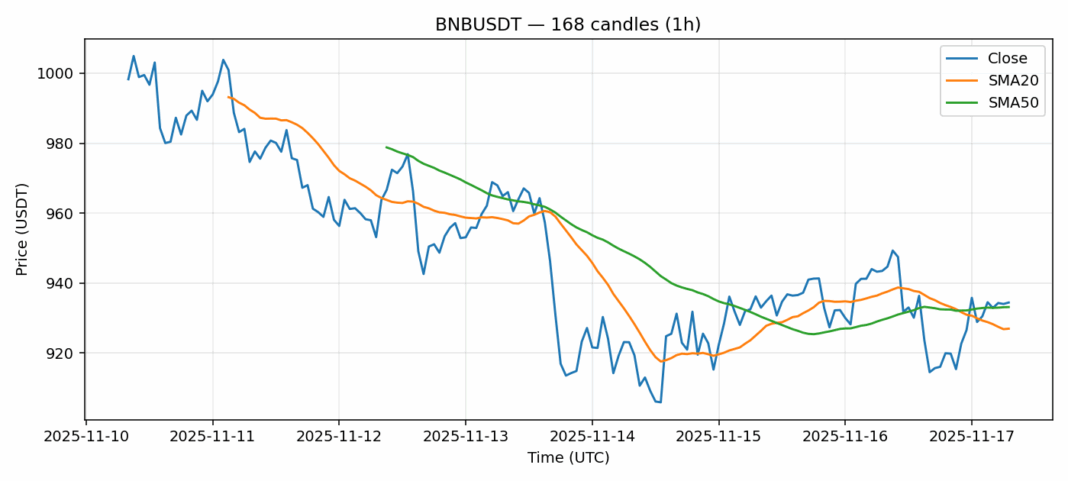

BNB is showing mixed signals at the $934 level, trading just above its 20-day SMA of $926.95 but slightly below the 50-day SMA of $933.14. The 0.91% decline over the past 24 hours suggests some profit-taking pressure, though the substantial $252 million trading volume indicates continued institutional interest. The RSI reading of 70.57 places BNB in overbought territory, signaling potential near-term consolidation. However, the relatively low volatility of 3.03% compared to typical crypto assets suggests controlled price action. Traders should watch for a decisive break above $940 for bullish continuation, with support holding firm at the $925-927 zone. Given the current technical setup, consider scaling into positions on dips toward the $920 support level while maintaining tight stop-losses below $915. The overall structure remains constructive despite the slight pullback, with BNB demonstrating relative strength against broader market weakness.

Key Metrics

| Price | 934.4300 USDT |

| 24h Change | -0.91% |

| 24h Volume | 252035367.80 |

| RSI(14) | 70.57 |

| SMA20 / SMA50 | 926.95 / 933.14 |

| Daily Volatility | 3.03% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).