Sentiment: Bullish

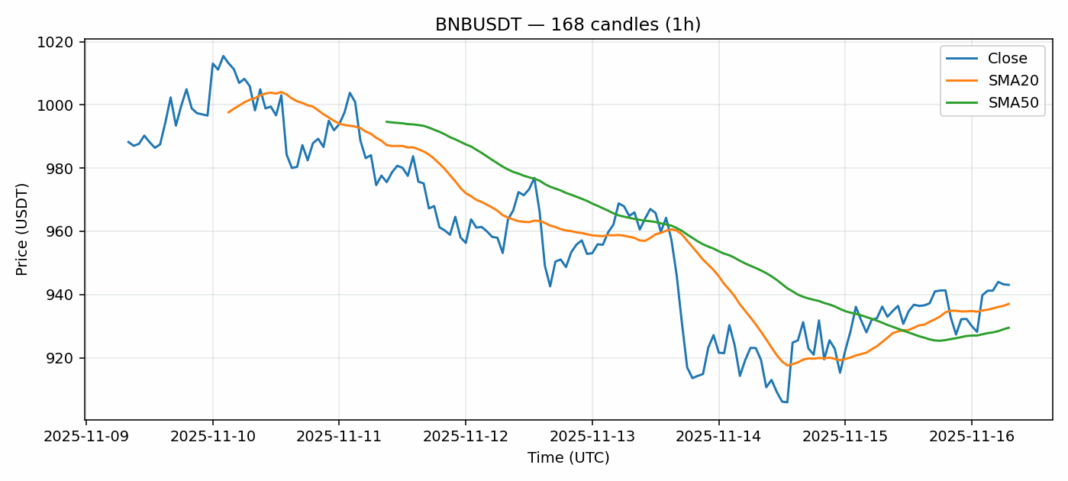

BNB continues to demonstrate resilience, trading at $943 with a modest 1.22% gain over the past 24 hours. The current price sits comfortably above both the 20-day SMA ($937) and 50-day SMA ($929), indicating underlying strength in the medium-term trend. With RSI at 52.59, BNB remains in neutral territory, suggesting room for further upside without immediate overbought concerns. The $138 million trading volume provides adequate liquidity, while volatility remains manageable at approximately 3%. The key resistance to watch is the psychological $950 level, which if broken convincingly, could open the path toward the $980-$1000 zone. Traders should consider accumulating on dips toward the $930 support level, with stop losses placed below $920. The positioning above both moving averages suggests the bulls maintain control, though cautious optimism is warranted given the broader market conditions.

Key Metrics

| Price | 943.0600 USDT |

| 24h Change | 1.22% |

| 24h Volume | 138706687.26 |

| RSI(14) | 52.59 |

| SMA20 / SMA50 | 937.03 / 929.48 |

| Daily Volatility | 2.97% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).