Sentiment: Neutral

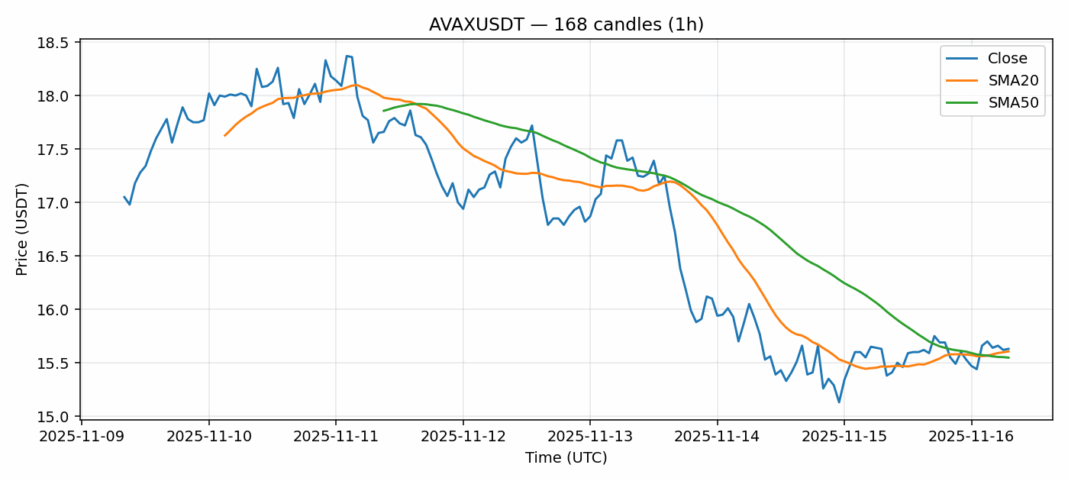

AVAX is showing consolidation around $15.63 with modest 6.4% gains over the past 24 hours. The current RSI reading of 43 suggests the asset is approaching oversold territory but hasn’t yet reached extreme levels, indicating potential for either further downside or a reversal. Trading volume remains healthy at nearly $20 million, showing sustained interest despite recent price action. The technical picture reveals AVAX trading slightly below its 20-day SMA ($15.61) while holding above the 50-day SMA ($15.55), suggesting near-term weakness but maintaining medium-term support. The 4.3% volatility reading indicates relatively stable conditions compared to typical crypto movements. Traders should watch for a decisive break above $15.80 for bullish confirmation or a drop below $15.40 for bearish continuation. Position sizing should remain conservative until clearer direction emerges, with stop-losses recommended below key support levels.

Key Metrics

| Price | 15.6300 USDT |

| 24h Change | 0.06% |

| 24h Volume | 19998097.17 |

| RSI(14) | 43.48 |

| SMA20 / SMA50 | 15.61 / 15.55 |

| Daily Volatility | 4.30% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).