Sentiment: Neutral

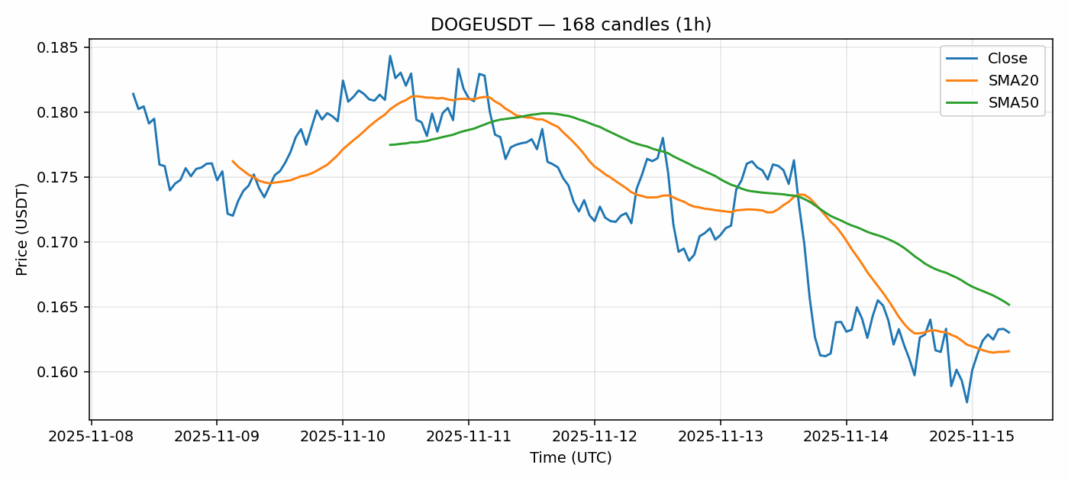

DOGE is showing consolidation around $0.163 after a modest 1.67% pullback over 24 hours. The meme coin continues to trade above its 20-day SMA ($0.1616) but faces resistance at the 50-day SMA ($0.1652), creating a tight trading range. With RSI at 54.1, DOGE sits in neutral territory with room for movement in either direction. The 24-hour volume of $244 million indicates decent trader interest, though volatility remains elevated at 4.1%. Current price action suggests DOGE is at a critical inflection point – a break above $0.165 could trigger momentum toward $0.17, while failure to hold $0.161 support may see a test of $0.155. Traders should watch for volume confirmation on any breakout and consider position sizing given DOGE’s inherent volatility. Short-term traders might range trade between $0.161-0.165, while longer-term holders should monitor broader market sentiment given DOGE’s correlation with crypto majors.

Key Metrics

| Price | 0.1630 USDT |

| 24h Change | -1.67% |

| 24h Volume | 244412234.24 |

| RSI(14) | 54.11 |

| SMA20 / SMA50 | 0.16 / 0.17 |

| Daily Volatility | 4.10% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).