Sentiment: Neutral

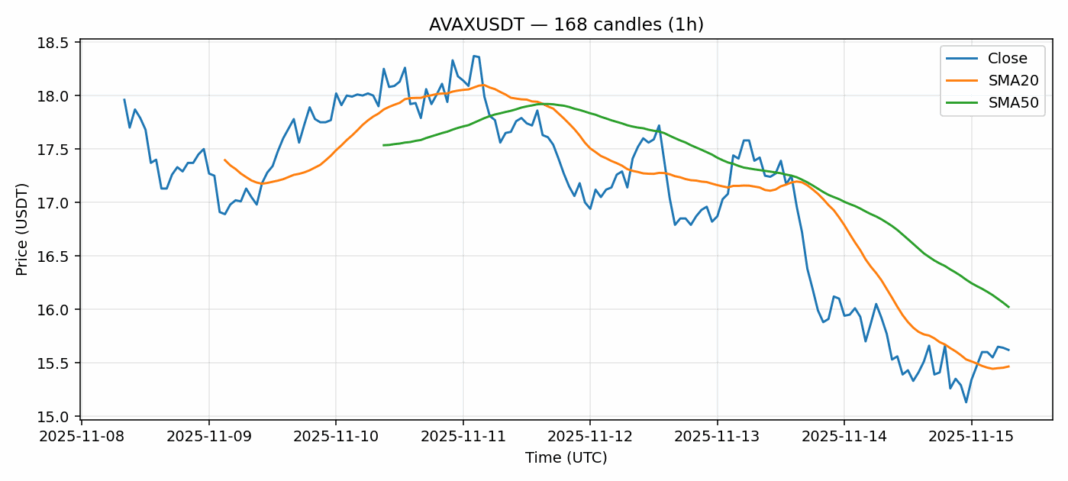

AVAX is showing mixed signals after a 2.5% pullback to $15.62, though trading volume remains robust at $66.5 million. The current price sits just above the 20-day SMA ($15.47) but below the 50-day SMA ($16.02), indicating near-term support but medium-term resistance. With RSI at 57, AVAX isn’t overbought yet, leaving room for upward movement if buyers step in. The 4.4% volatility suggests typical crypto swings rather than extreme instability. Traders should watch the $15.50 level closely – a sustained break below could trigger further selling toward $15.00 support. Conversely, reclaiming $16.20 could signal momentum returning. Given the technical positioning, consider scaling into positions with tight stops rather than chasing moves in either direction. The high volume indicates institutional interest remains, providing underlying strength despite the recent dip.

Key Metrics

| Price | 15.6200 USDT |

| 24h Change | -2.50% |

| 24h Volume | 66543549.82 |

| RSI(14) | 57.06 |

| SMA20 / SMA50 | 15.46 / 16.02 |

| Daily Volatility | 4.42% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).