Sentiment: Neutral

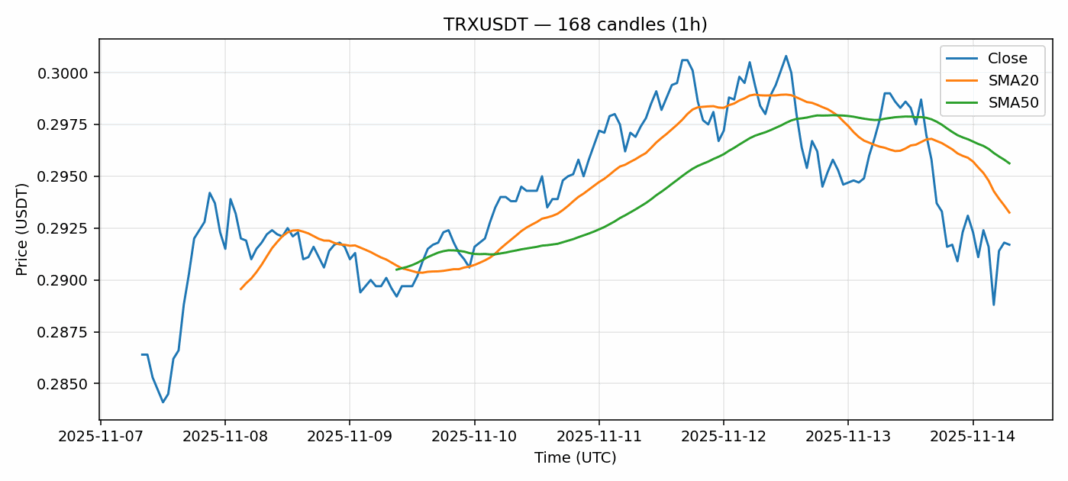

TRX is showing signs of consolidation after a recent pullback, currently trading at $0.2917 with a 2.1% decline over the past 24 hours. The technical picture presents mixed signals that warrant careful attention. The RSI reading of 43.4 indicates neither overbought nor oversold conditions, suggesting room for movement in either direction. More concerning is TRX’s position below both its 20-day SMA ($0.29325) and 50-day SMA ($0.295624), indicating near-term bearish pressure. However, the relatively high 24-hour trading volume of $133 million suggests continued institutional interest despite the price decline. The moderate volatility of 1.47% points to controlled price action rather than panic selling. For traders, I’d recommend waiting for a confirmed break above the 20-day SMA before considering long positions, with a stop-loss around $0.285. The current levels could present accumulation opportunities for patient investors, but risk management remains crucial given the broader market uncertainty.

Key Metrics

| Price | 0.2917 USDT |

| 24h Change | -2.11% |

| 24h Volume | 132996771.94 |

| RSI(14) | 43.42 |

| SMA20 / SMA50 | 0.29 / 0.30 |

| Daily Volatility | 1.47% |

TRON — 1h candles, 7D window (SMA20/SMA50, RSI).