Sentiment: Bullish

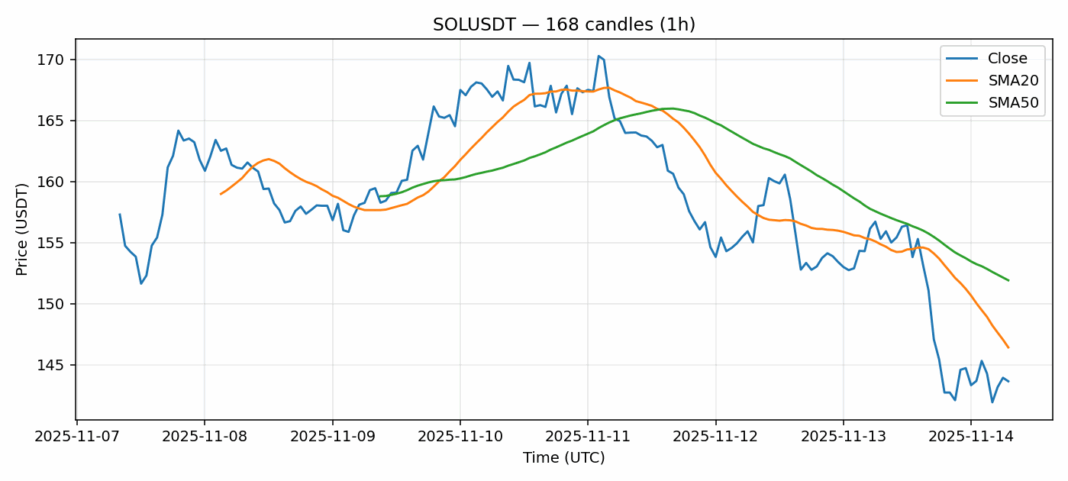

SOL is showing signs of capitulation after an 8.36% decline to $143.64, with RSI dipping into oversold territory at 39.7. The current price sits below both the 20-day SMA ($146.42) and 50-day SMA ($151.92), indicating persistent bearish pressure. However, the elevated volatility of 4.17% combined with substantial $900M+ daily volume suggests we’re approaching a potential inflection point. Historically, SOL has shown strong bounce-back characteristics from RSI levels below 40. Traders should watch for consolidation above $140 as a potential accumulation zone. Consider scaling into long positions with tight stops below $138, targeting a retest of the 20-day SMA resistance. The high volume decline could represent final flush-out before reversal, but remain cautious of broader market sentiment dragging prices lower.

Key Metrics

| Price | 143.6400 USDT |

| 24h Change | -8.36% |

| 24h Volume | 900934648.72 |

| RSI(14) | 39.70 |

| SMA20 / SMA50 | 146.42 / 151.92 |

| Daily Volatility | 4.17% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).