Sentiment: Bullish

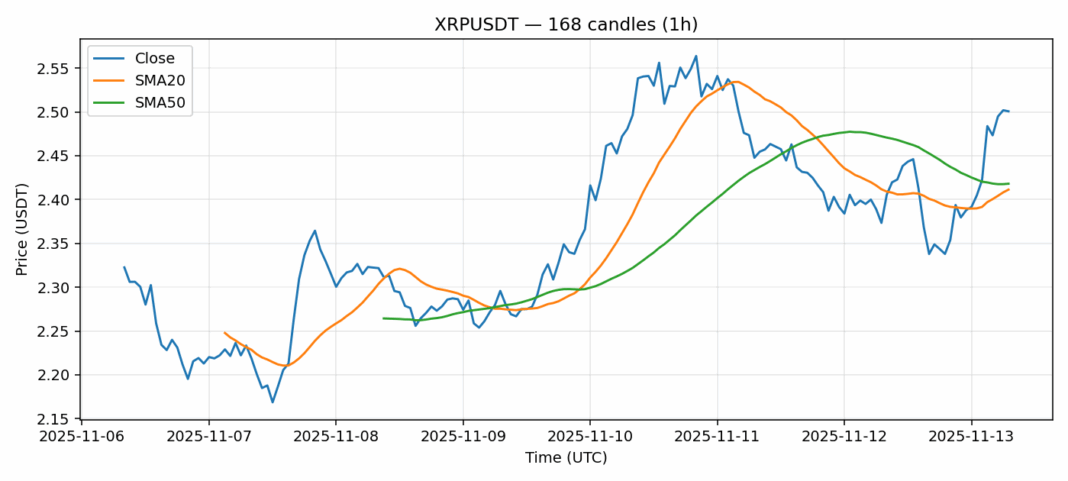

XRP is showing strong momentum with a 4.9% surge to $2.50, decisively breaking above both the 20-day ($2.41) and 50-day ($2.42) SMAs. This technical breakout, combined with substantial $429M volume, suggests institutional accumulation. However, the RSI reading of 83.7 indicates severely overbought conditions, creating near-term vulnerability. Traders should watch for potential profit-taking around the $2.55 resistance level. While the trend remains upward, position sizing should be conservative given the elevated volatility of 3.7%. Consider scaling into positions on pullbacks toward $2.45 support, using tight stops for protection. The volume profile suggests this isn’t merely retail FOMO, but sustained buying pressure could face headwinds at these extended levels.

Key Metrics

| Price | 2.5009 USDT |

| 24h Change | 4.89% |

| 24h Volume | 429130678.38 |

| RSI(14) | 83.67 |

| SMA20 / SMA50 | 2.41 / 2.42 |

| Daily Volatility | 3.70% |

Ripple — 1h candles, 7D window (SMA20/SMA50, RSI).