Sentiment: Bullish

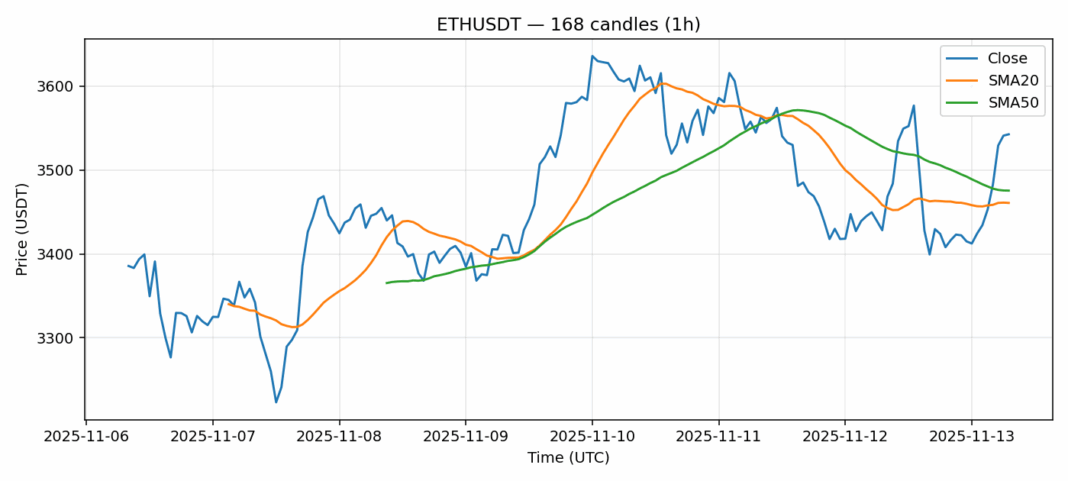

Ethereum continues to show impressive momentum, trading at $3,542 with a solid 3% gain over the past 24 hours. The current RSI reading of 81.85 indicates severely overbought conditions, suggesting traders should exercise caution despite the bullish trend. ETH remains above both its 20-day SMA ($3,460) and 50-day SMA ($3,475), confirming the underlying strength. However, the elevated volatility at 3.38% combined with overbought technicals points to potential near-term consolidation. Volume remains robust at over $2.1 billion, indicating sustained institutional interest. For traders, consider taking partial profits at current levels while maintaining core positions. Wait for a pullback toward $3,460-$3,480 support before adding new positions. The overall structure remains constructive, but risk management is crucial given the extended technical readings.

Key Metrics

| Price | 3542.6000 USDT |

| 24h Change | 3.01% |

| 24h Volume | 2169140709.93 |

| RSI(14) | 81.85 |

| SMA20 / SMA50 | 3460.79 / 3475.49 |

| Daily Volatility | 3.38% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).