Sentiment: Bullish

DOGE is showing strong momentum with a 2.55% surge to $0.176, significantly outpacing both its 20-day ($0.173) and 50-day ($0.174) SMAs. However, the RSI reading of 83 signals severely overbought conditions, suggesting this rally may be overheating. Trading volume remains robust at nearly $198 million, indicating sustained interest, but the elevated 4.16% volatility warrants caution. While the technical setup appears bullish in the short term, traders should prepare for potential pullbacks given the extreme RSI levels. Consider taking partial profits near current levels and setting stop-losses below $0.172 for protection. Wait for a healthy retracement toward the 20-day SMA before adding new positions. The meme coin’s volatility demands disciplined risk management despite the positive price action.

Key Metrics

| Price | 0.1764 USDT |

| 24h Change | 2.55% |

| 24h Volume | 197871480.59 |

| RSI(14) | 82.89 |

| SMA20 / SMA50 | 0.17 / 0.17 |

| Daily Volatility | 4.16% |

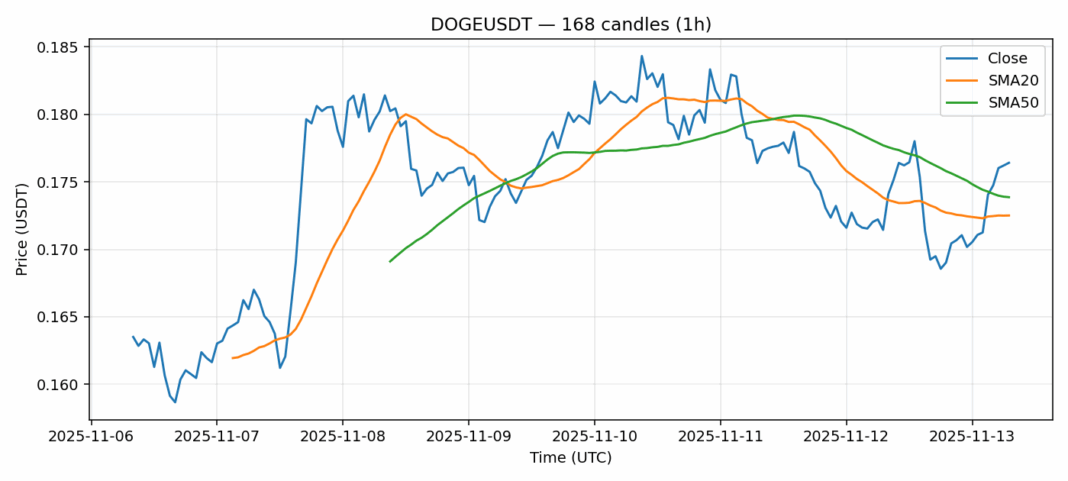

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).